Lost amidst all the talk of a second wave of Covid-19, more economic shutdowns, and even greater stimulus is one simple but incredibly important question…

Just who is going to pay for all of this?!?!

The US was already ~$23 trillion in debt BEFORE the economy was shut down. That put our Debt to GDP ratio at 105%. And we’ve since added $3 trillion more bringing our total debt load to over $26 trillion.

Now the government is talking about introducing another even larger $2.5 trillion stimulus program. If this passes, we could easily add $6 trillion in national debt this year.

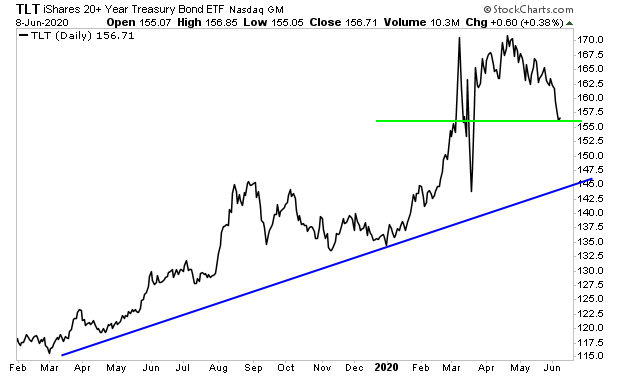

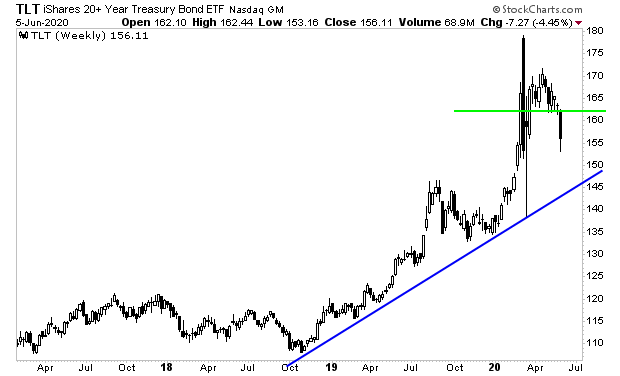

This will work temporarily, as the bond market is showing tremendous demand for US debt based on safe haven buying and fears of continued economic weakness.

However, at some point, the elites who run this country will begin looking for new sources of capital to finance their schemes. If history has shown us anything, it’s that once the government seizes power, it rarely gives it back.

So, you can expect wealth taxes, cash grabs and worse in the coming months and years. The IMF has already called for nations around the world to introduce a wealth tax of 10% on NET WEALTH as soon as possible.

The reasoning?

To shore up sovereign balance sheets (reduce debt levels).

The Elites will introduce these ideas as new proposals based on “fairness” or “helping America out” but the reality is that the Powers That Be have been working on this for well nearly a decade.

Did you know that in 2011, the US passed legislation that would allow regulators to:

1) Freeze bank accounts and use them to “bail-in” financial institutions/ banks.

2) Close the “gates” on investment funds/ money market funds to stop you from getting your money out.

3) Impose wealth taxes and seize unused assets.

If you think that’s bad, consider that the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

As I write this there are 29 remaining.

Receive a daily recap featuring a curated list of must-read stories.

You can pick up a FREE copy at:

https://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research