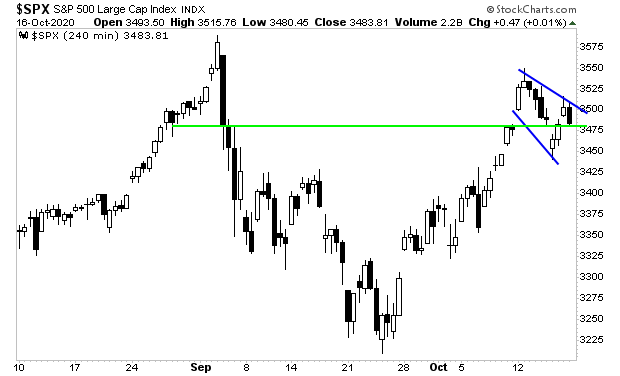

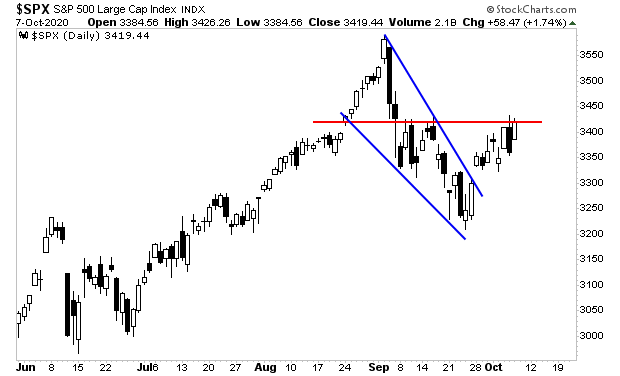

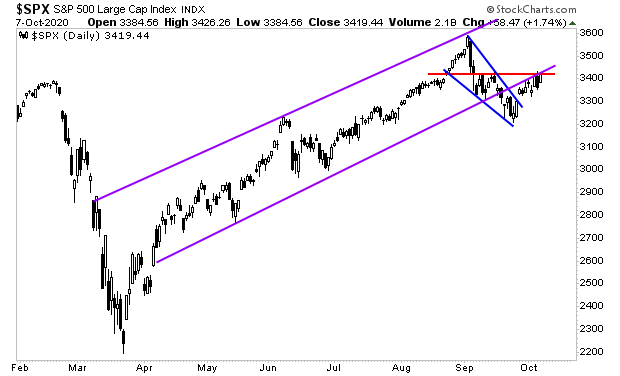

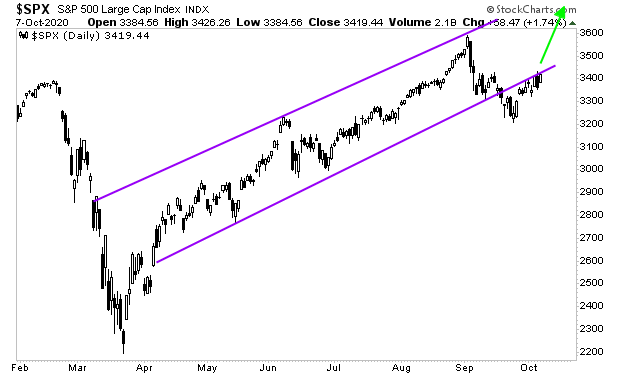

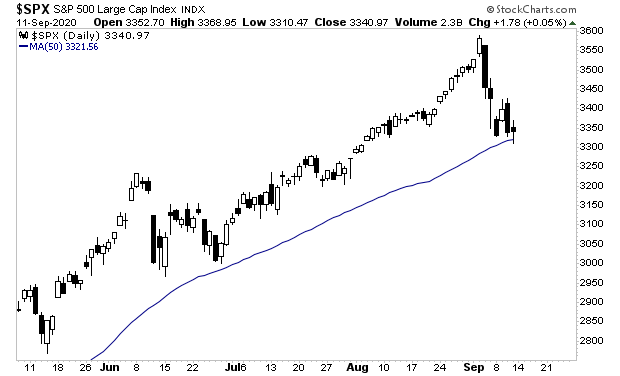

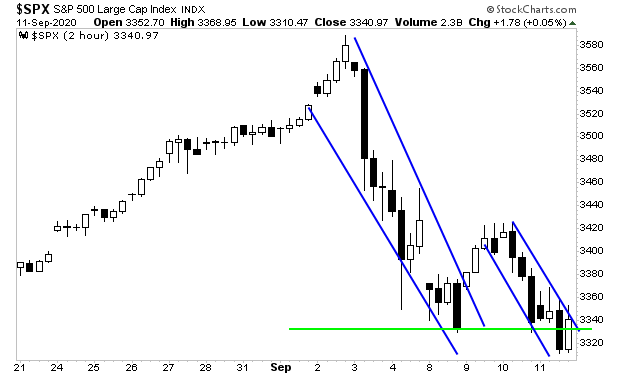

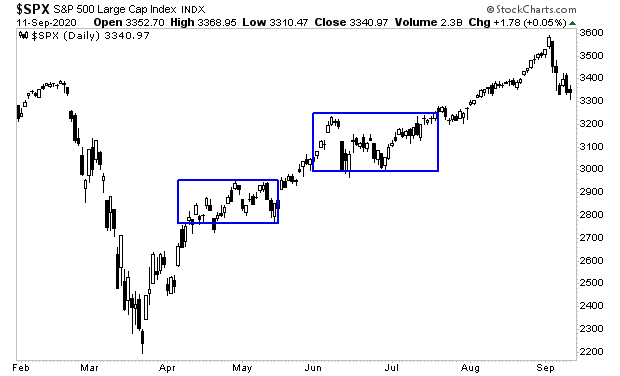

The markets are preparing for a monster move.

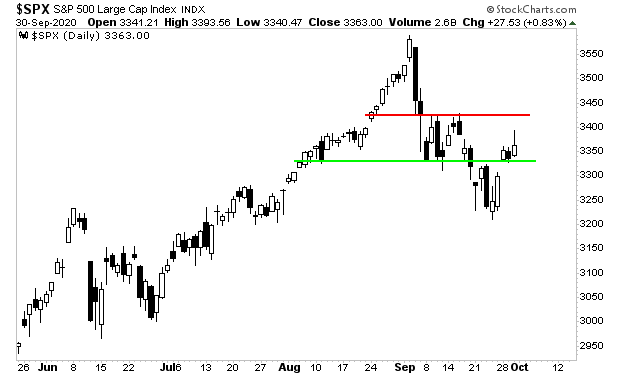

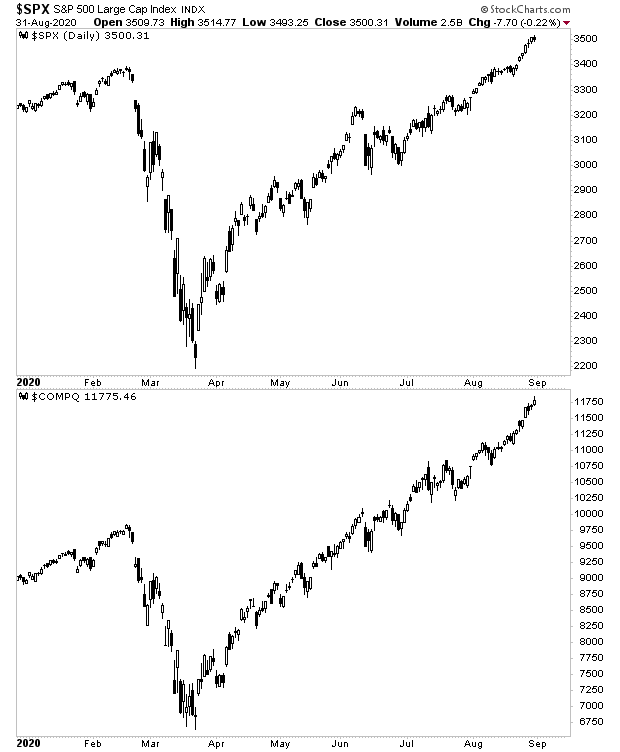

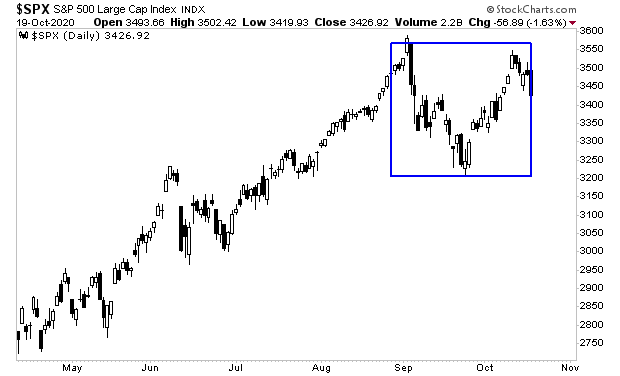

It’s been an exciting couple of months, but despite all the action the S&P 500 has effectively gone nowhere since late August.

Whenever we break out of this range, the move will be explosive.

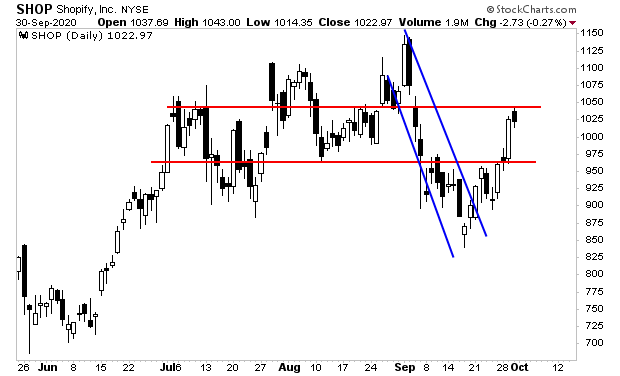

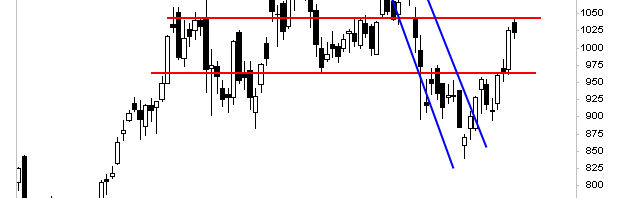

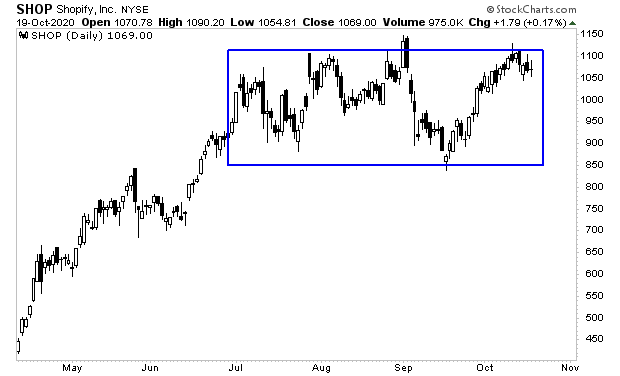

The one stock I’m watching closely for signs of the move is Shopify (SHOP).

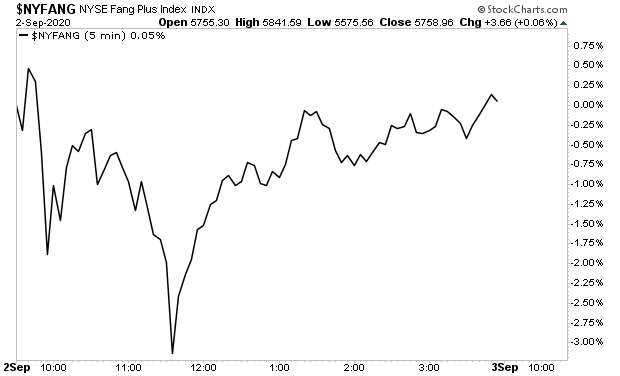

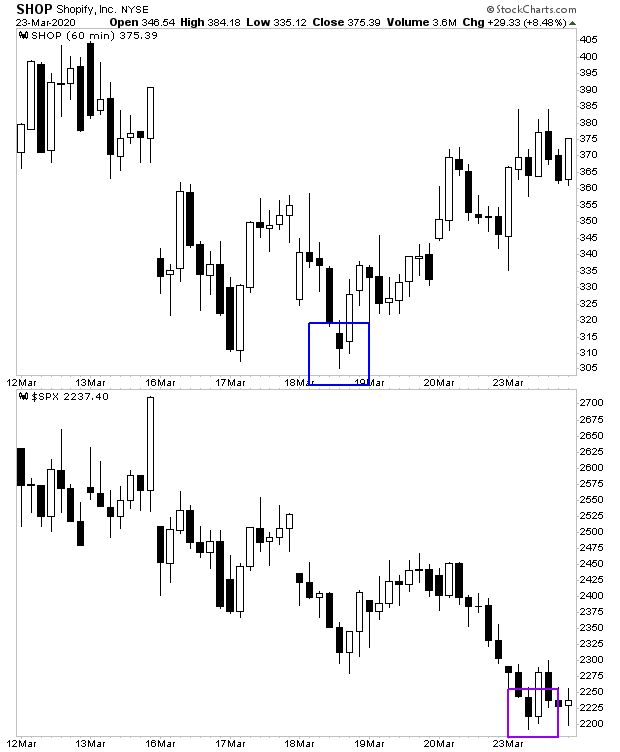

SHOP bottomed March 18th (blue square) a full FIVE days before the broader market did on March 23rd (purple square).

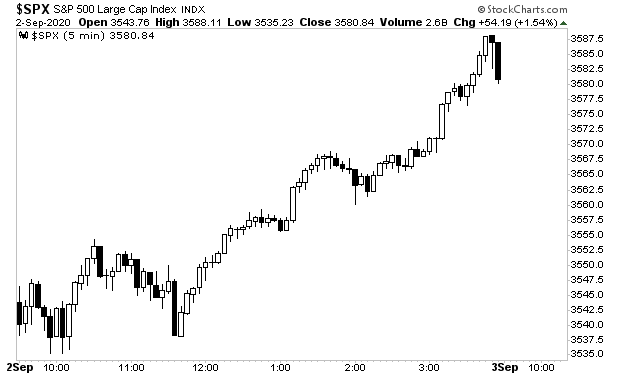

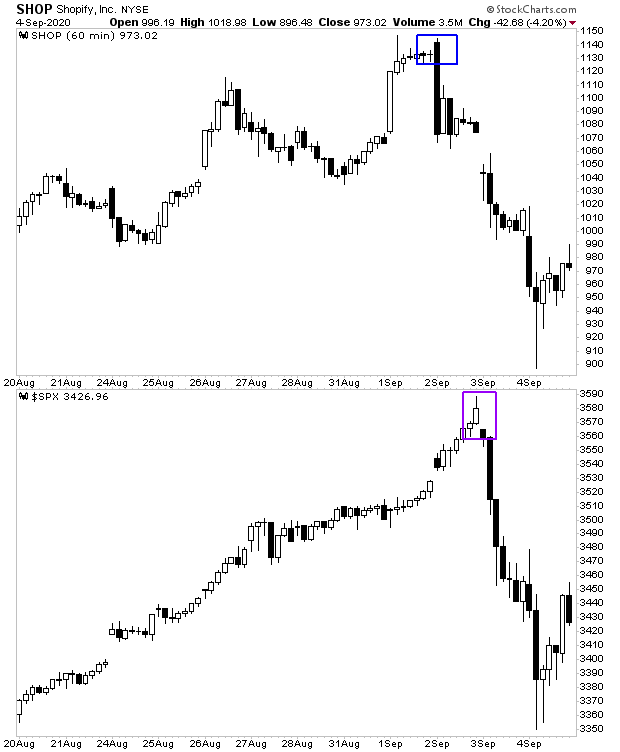

Put simply, SHOP lead the market by a wide margin out of the March bottom. Similarly, it peaked hours before the broader market did in early September.

Put simply, SHOP has been leading the market at every major turn for months.

So, what’s it saying now?

Despite the recent correction in stocks, SHOP is holding up well and remains close to the top of its consolidation range. If it can finally break that range with conviction, we’ll see a MAJOR bull run start in the broader market.

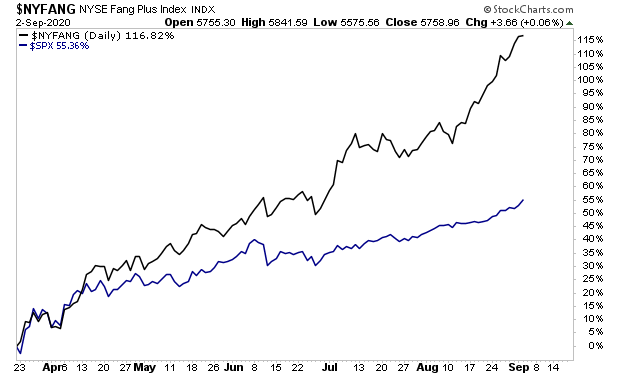

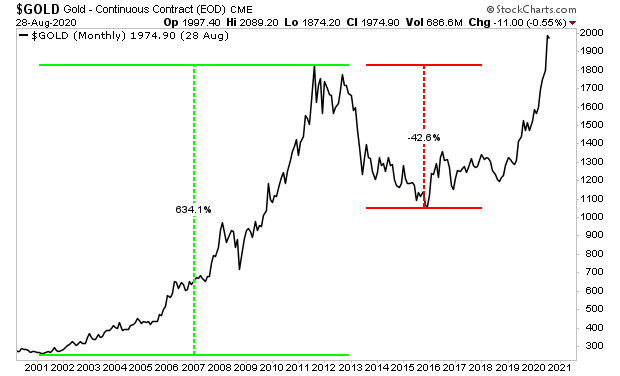

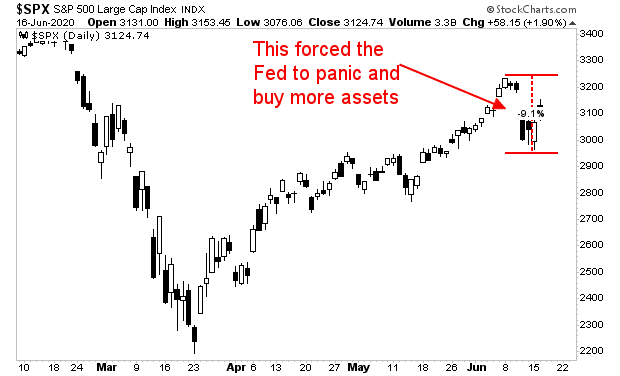

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

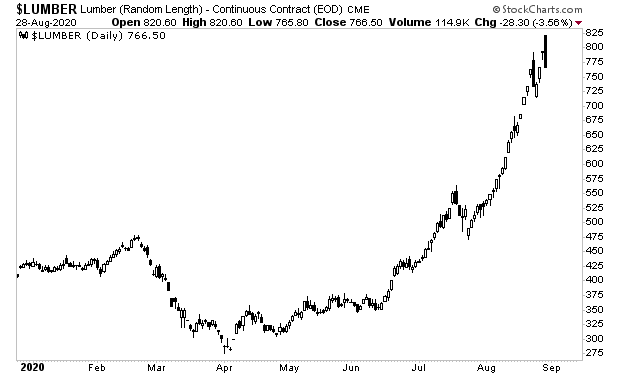

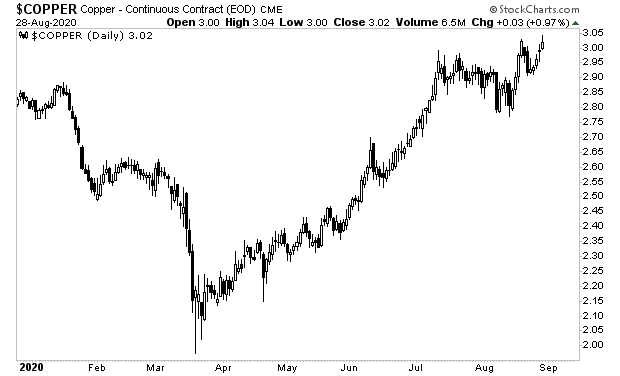

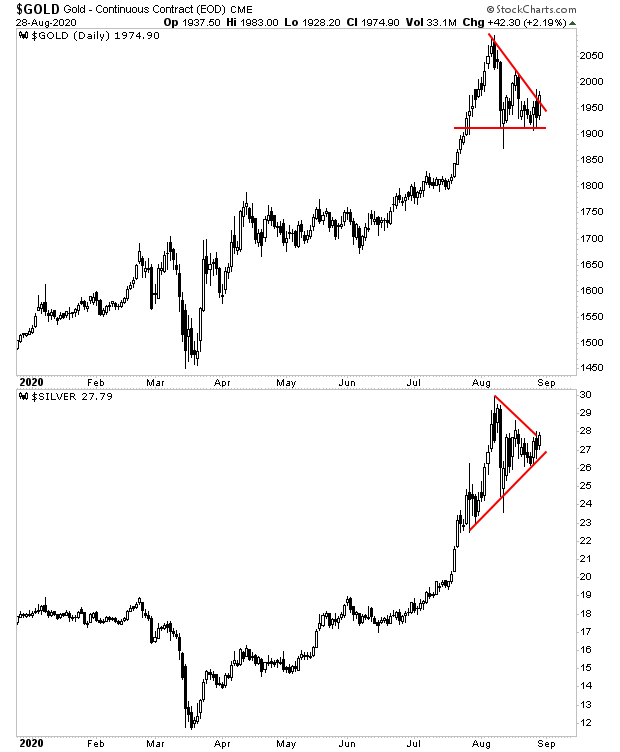

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research