By Graham Summers, MBA

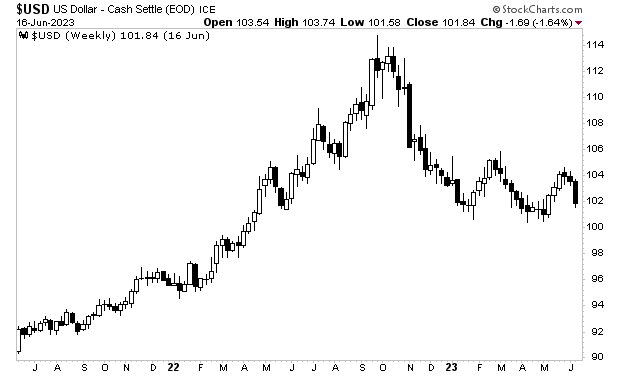

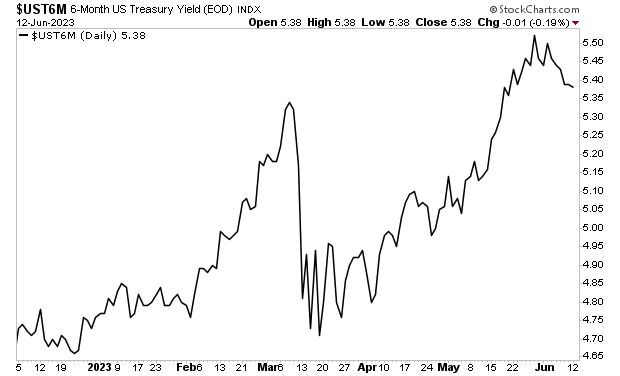

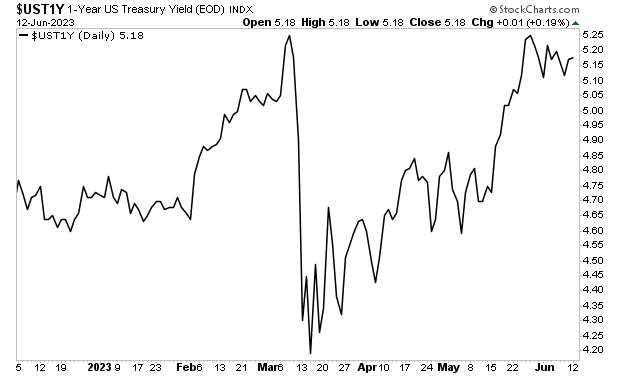

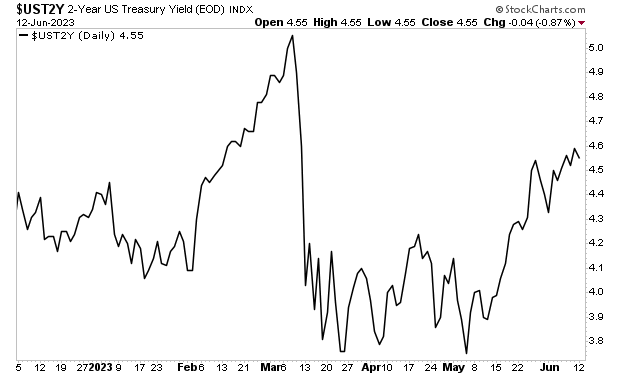

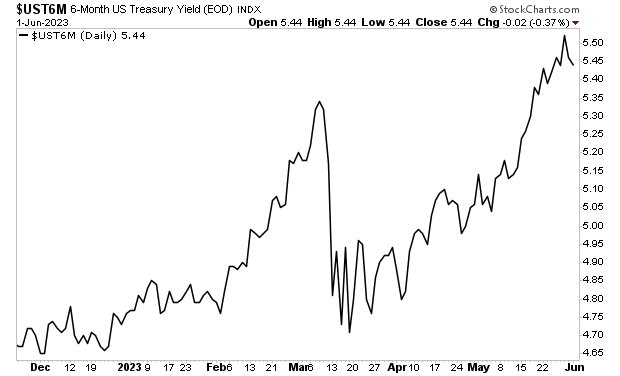

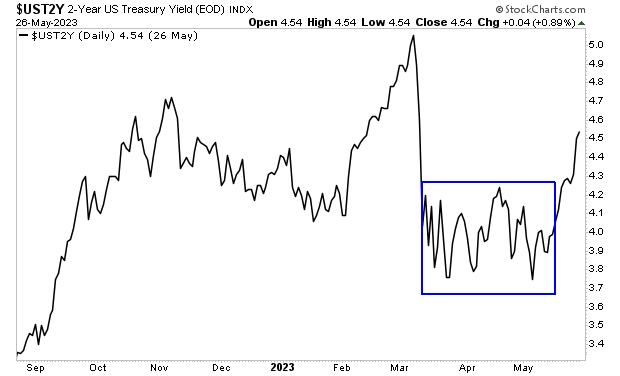

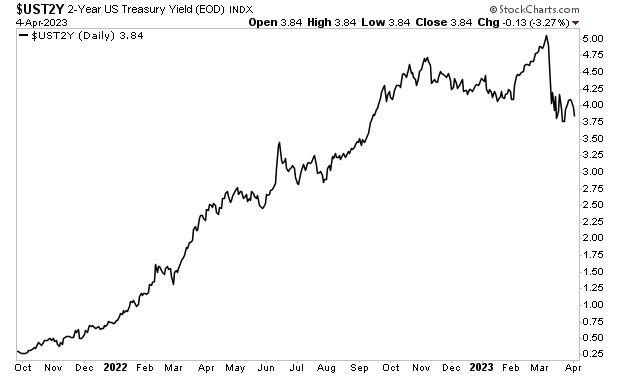

The Fed has raised interest rates from 0.25% to 5.25% in the span of 16 months.

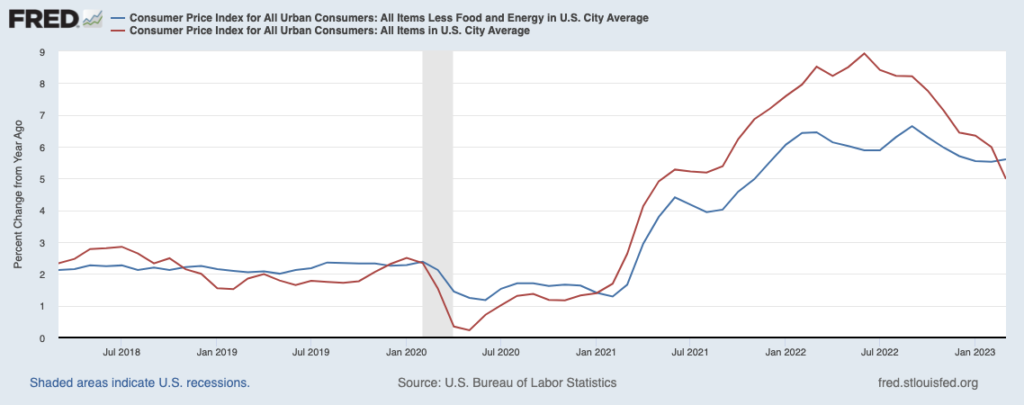

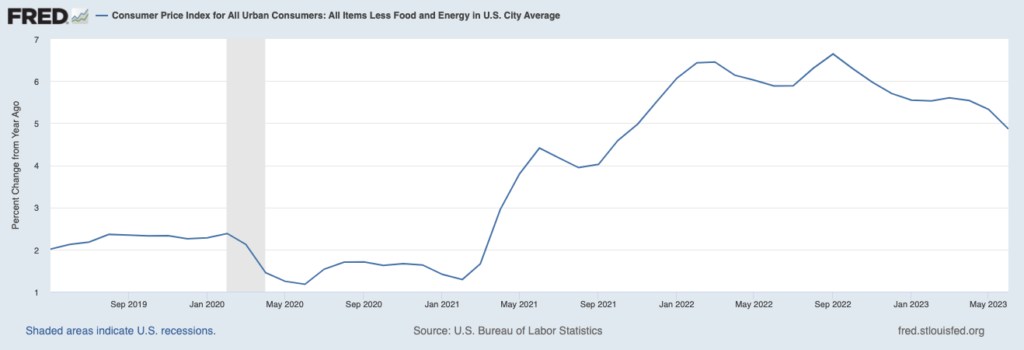

And yet…inflation has yet to disappear in any significant fashion.

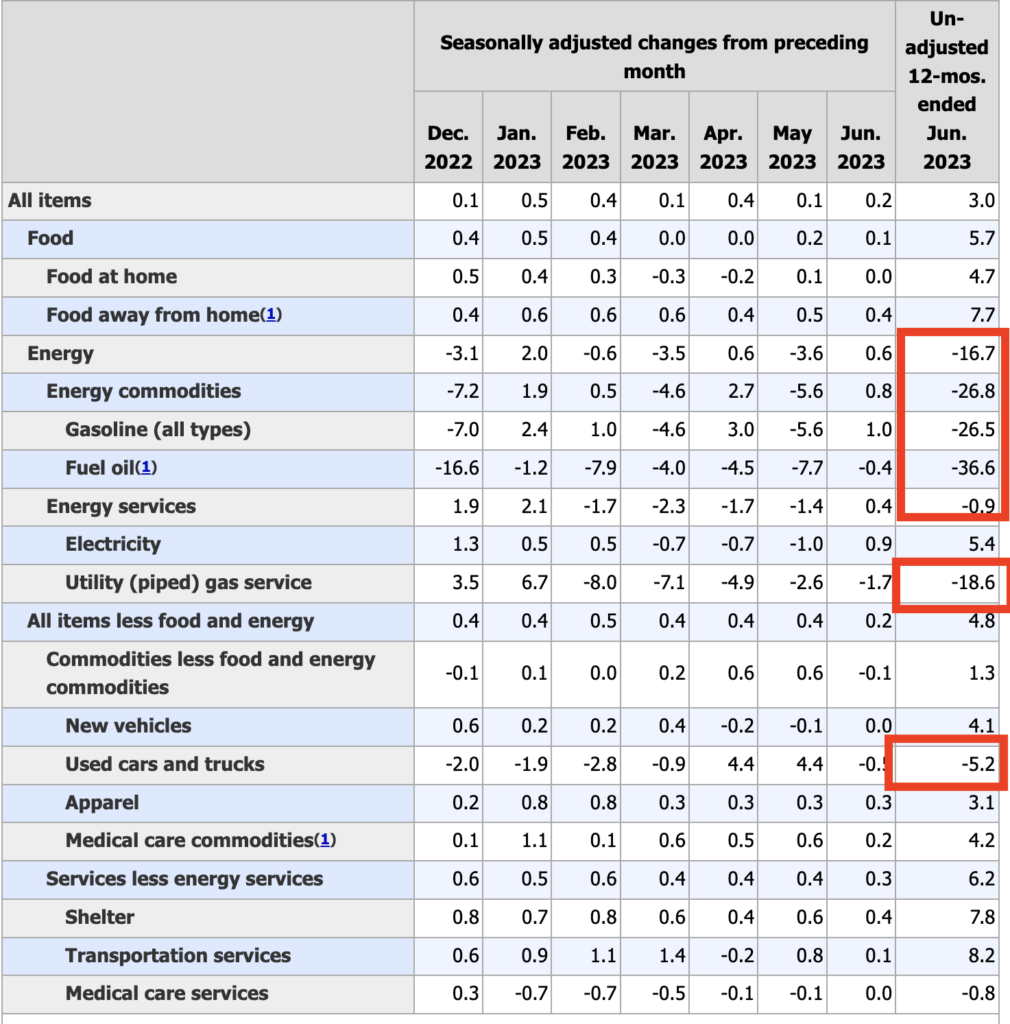

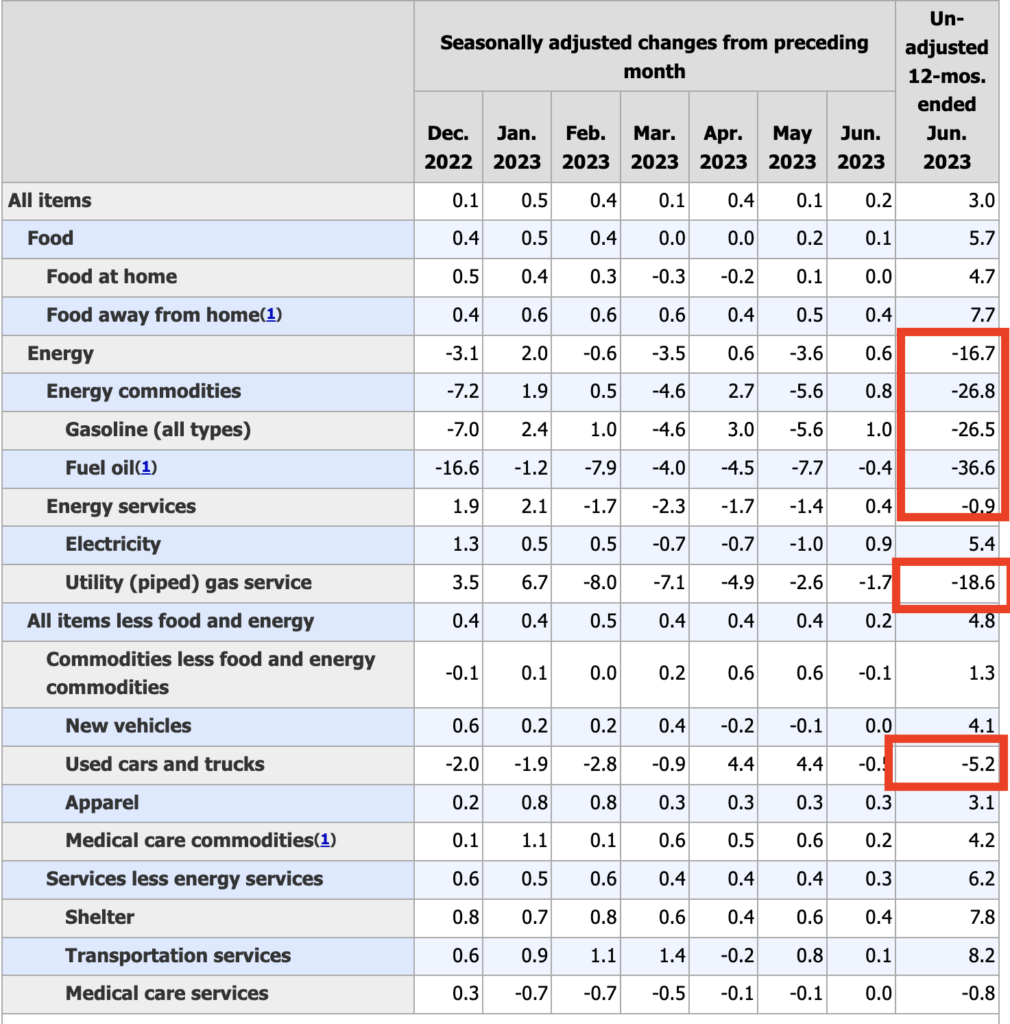

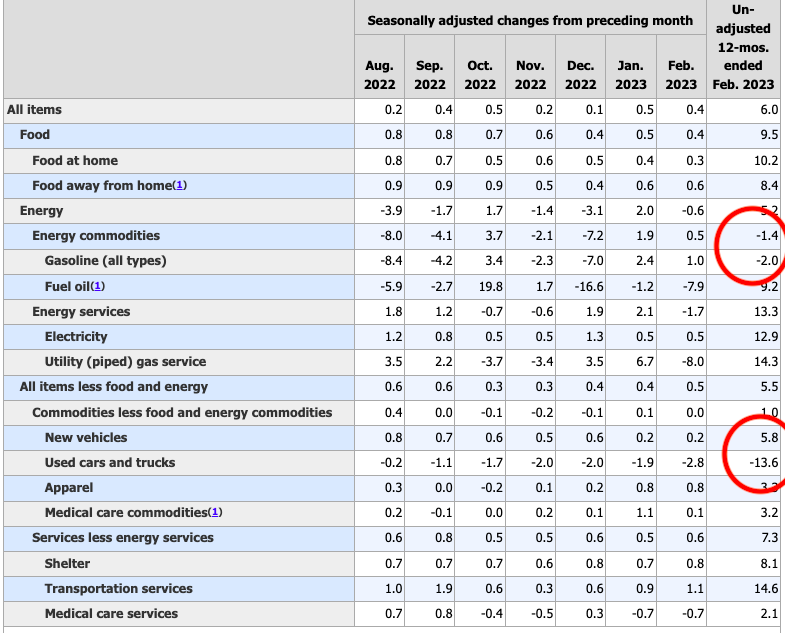

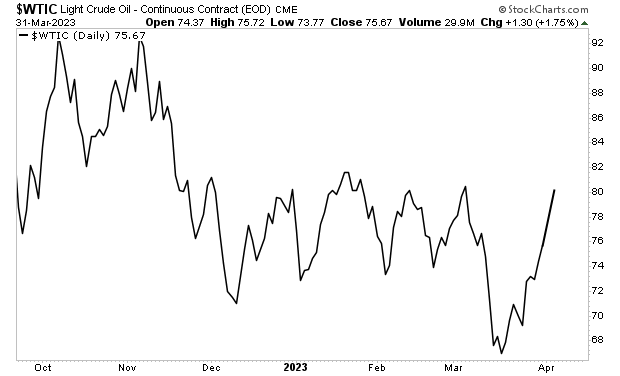

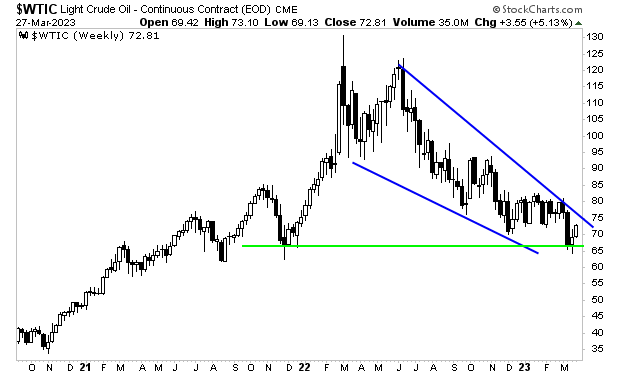

As I noted earlier this week, the ONLY data points in the CPI that are DOWN year over year are energy prices. When you strip out energy and food prices you find that core CPI is only slightly down. As I write this, it’s still clocking in at 4.8%… after fluctuating around 5% for most of 2023.

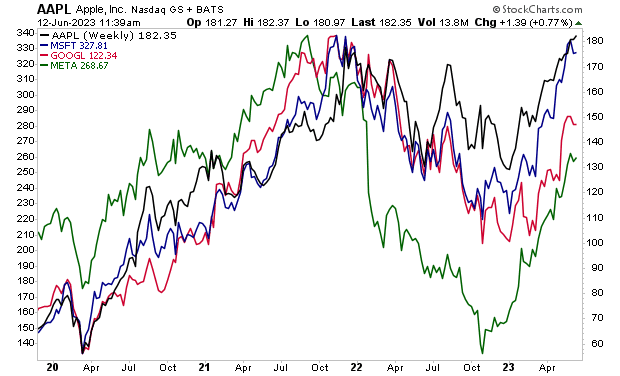

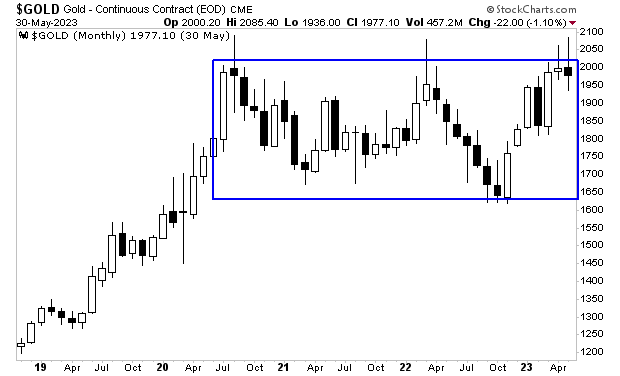

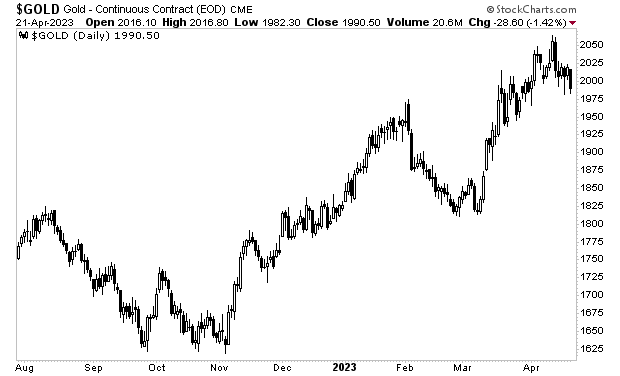

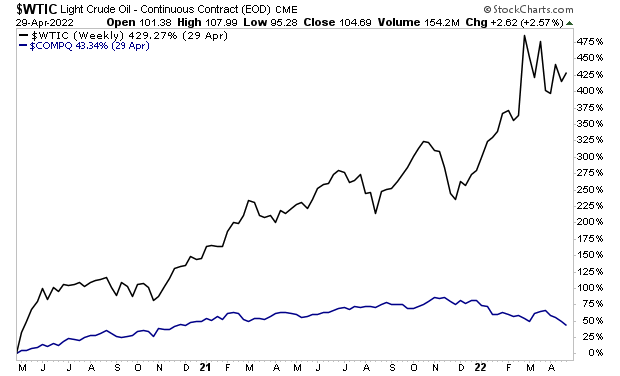

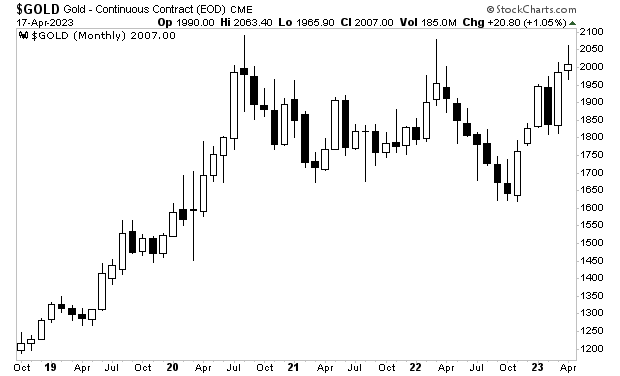

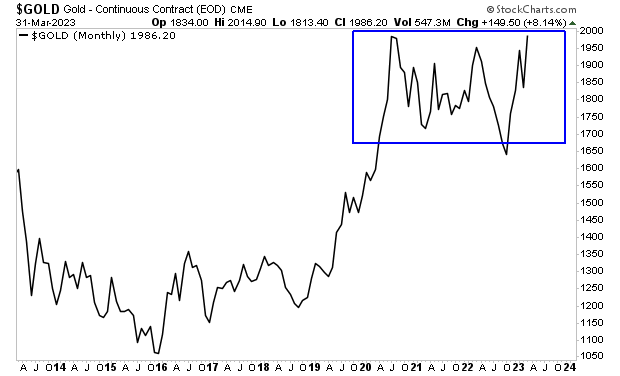

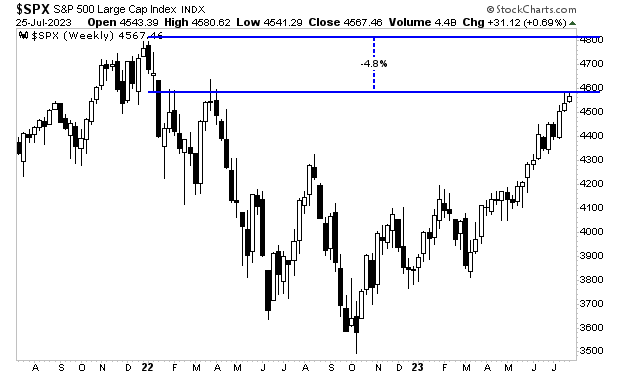

Moreover, asset inflation is out of control.

Stocks are less than 5% off their all time highs, despite one of the most aggressive rate hike cycles in history!

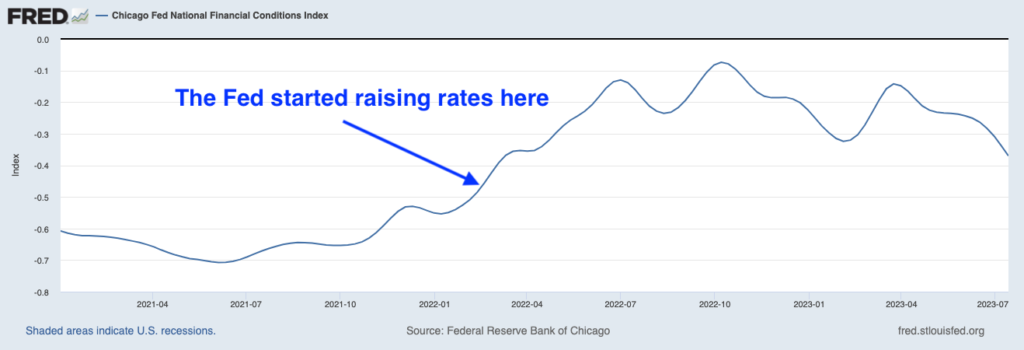

While financial conditions are roughly as loose as they were BEFORE the Fed started raising rates!

What’s going on here?

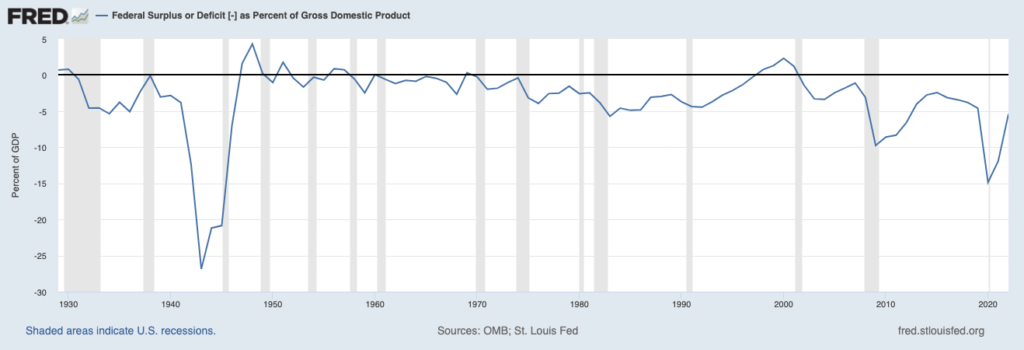

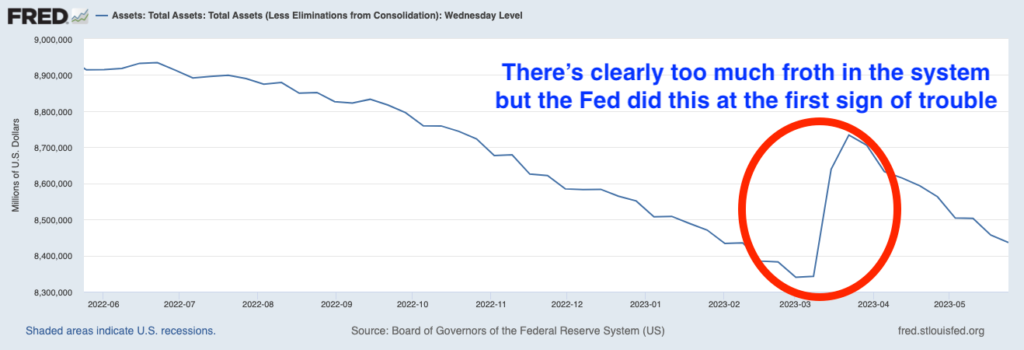

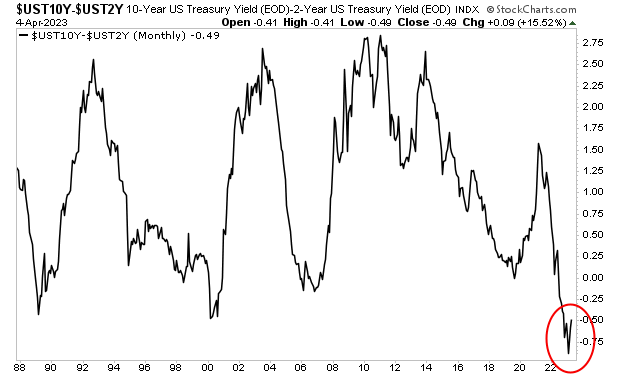

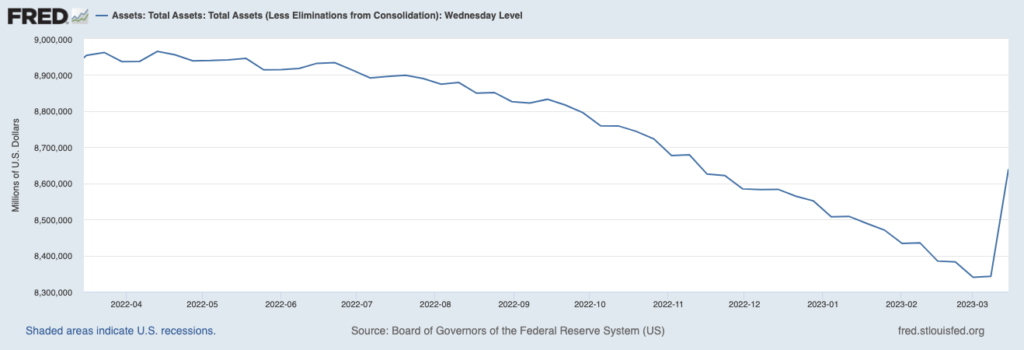

What’s going on is that the Fed is repeating the same mistake it initially made during the last major inflationary bout in the U.S. in the 1970s: focusing on rate hikes as opposed to draining excess reserves/ liquidity from the financial system.

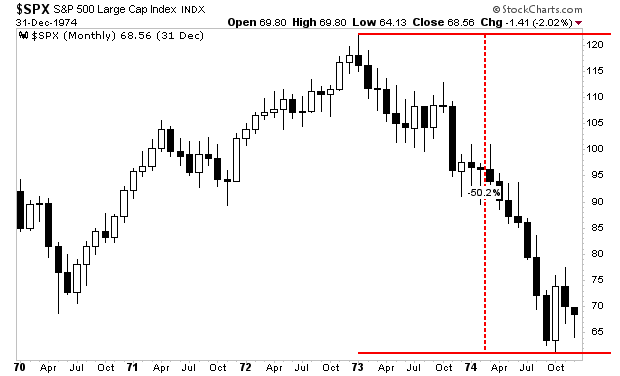

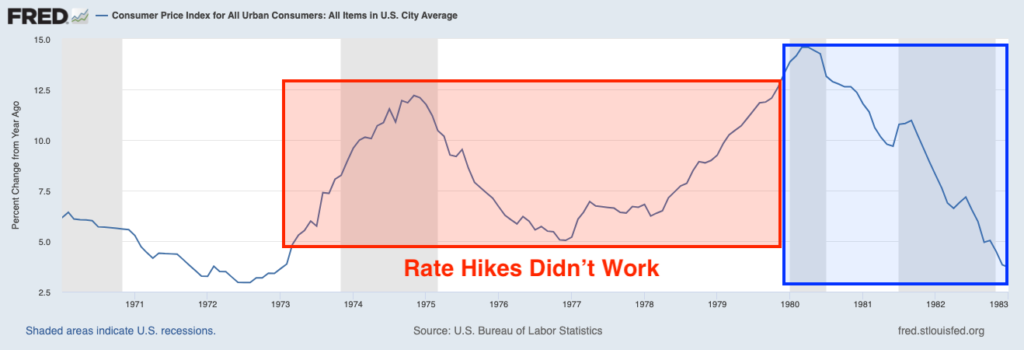

During the first round of inflation from 1972-1975, the official inflation measure, the Consumer Price Index or CPI, rose from 3.3% to 11.1%. During this period, the Fed, chaired by Arthur Burns, attempted to rein in inflation using rate hikes. This succeeded in triggering a recession, but failed to end inflation: CPI only fell to 5.7% in 1976 before rebounding and eventually peaking at 13% in 1980.

Burns was replaced William Miller as Fed Chair in 1978, but Miller only lasted a year, as his efforts to end inflation proved similarly futile: the Fed raised rates from 6.75% to 10.5% during Miller’s tenure, but inflation continued to rise from 7.6% to 11.3%

It was only when Paul Volcker took the reins as Fed Chair in August 1979 that things changed. Volcker shifted the Fed’s focus from rate hikes to draining excess reserves/ liquidity from the financial system. The goal was to remove the froth from the financial system, while letting rates move in a wider range in order to tighten policy to the point that inflation finally disappeared.

The effect was a severe recession (July 1981-November 1982), but CPI also came down, eventually falling to ~3% in 1983.

The below chart of CPI in the 1970s is clear: rate hikes didn’t end inflation… but draining excess reserves did.

Unfortunately for us today, the Fed is repeating the EXACT same mistake it made from 1972-1979. And those investors who are properly positioned to profit from this mistake will do extremely well as I’ll outline in tomorrow’s article.

In the meantime, if you’re in the market for someone who can help you profit from the Fed’s blunders, I can help you not only thrive but achieve tremendous financial success.

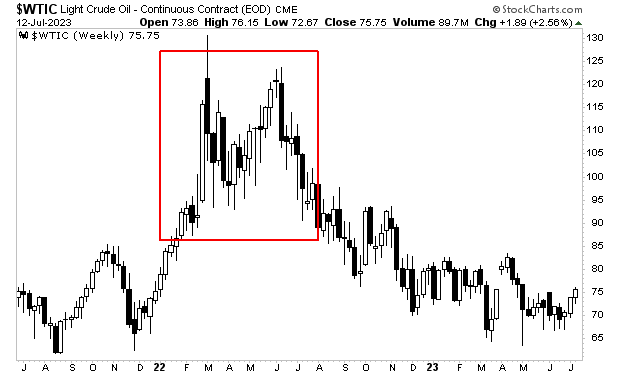

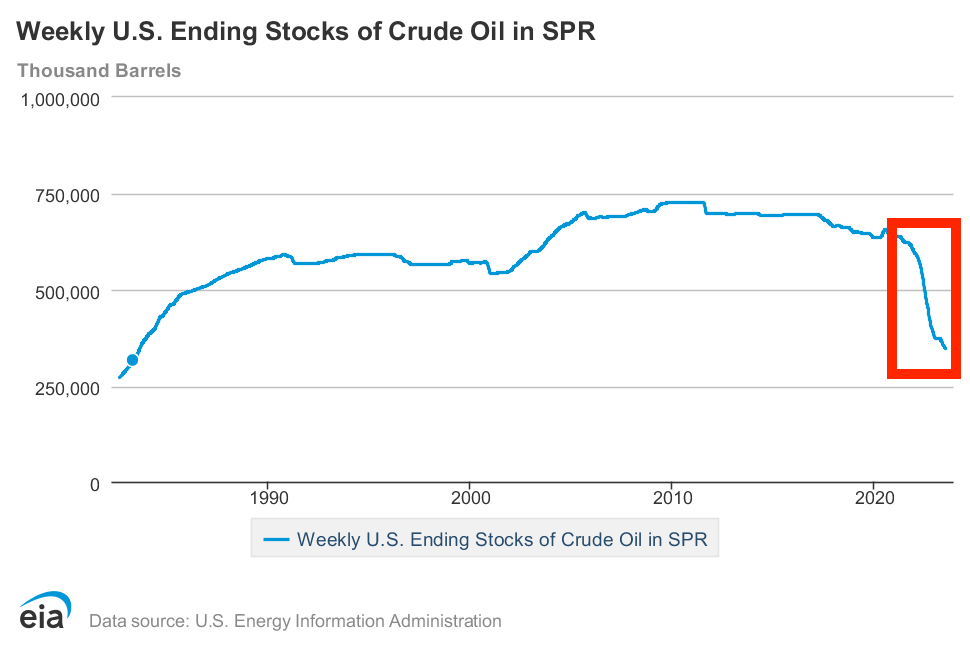

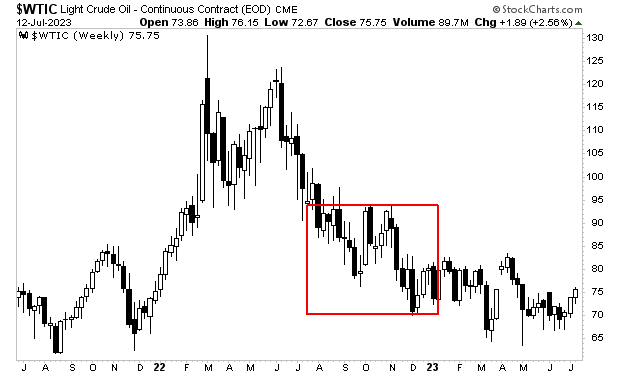

This opens the door to some VERY inflationary surprises in the near future. And those who are positioned to profit from this could see some absolutely stunning returns.

We recently outlined a unique “of the radar” investment that will could EXPLODE higher as inflation turns back up. We detail this investment in an investment report called Billionaire’s “Green Gold.”

It details the actions of a family of billionaires who literally made their fortunes investing in inflationary assets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html