By Graham Summers, MBA

The markets have reached a new level of stupidity.

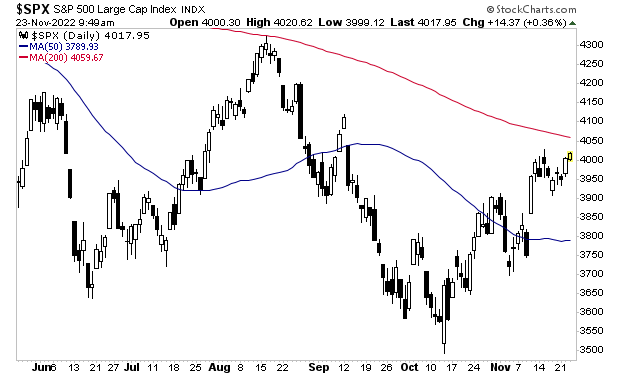

Stocks are exploding higher based on inflation coming in at 7.1% Year over Year. This is apparently great news because Wall Street expected the number to be somewhere between 7.2% and 7.6%.

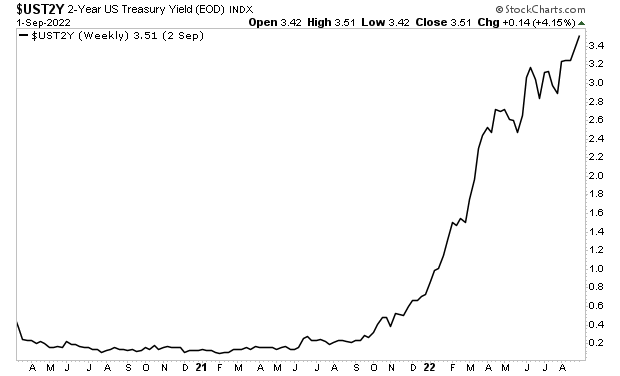

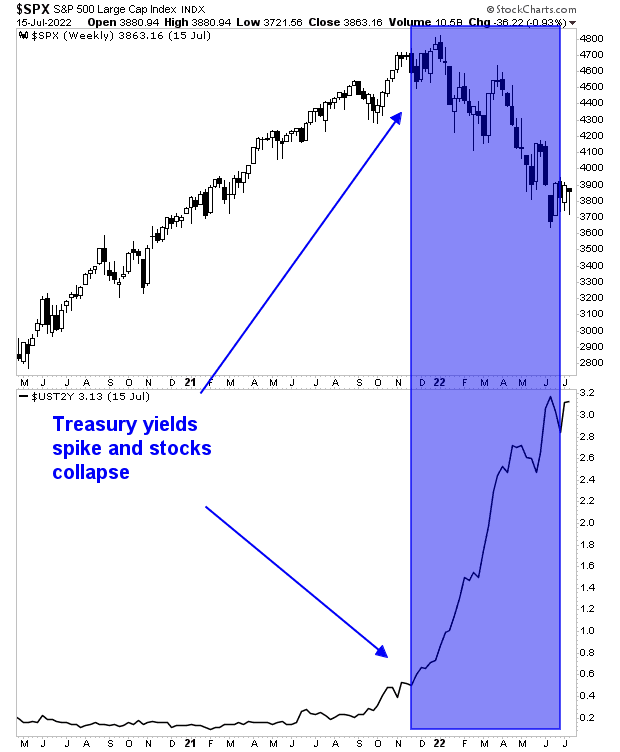

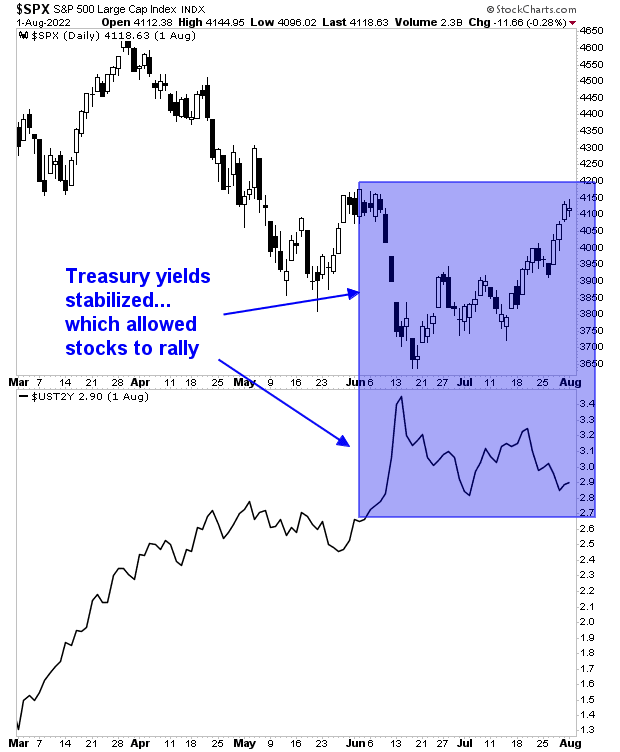

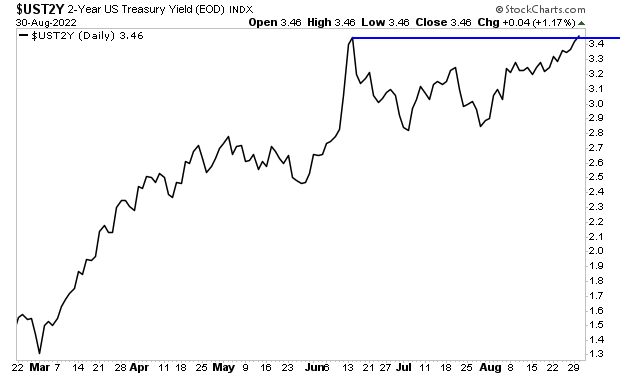

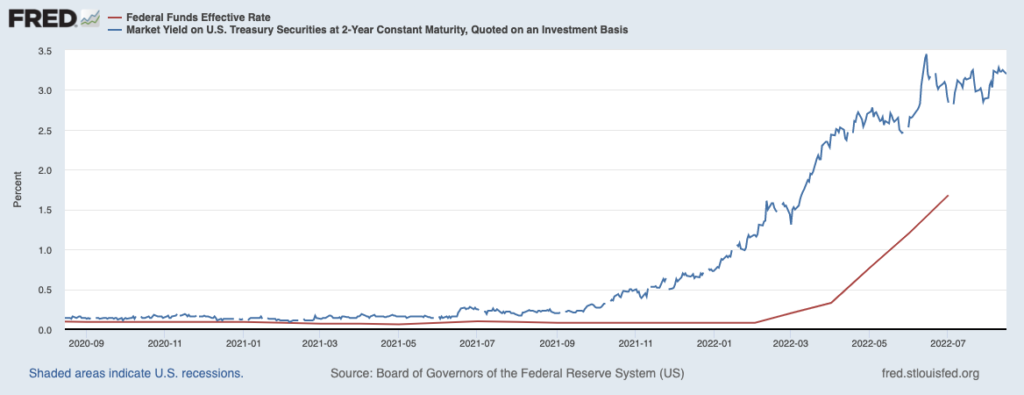

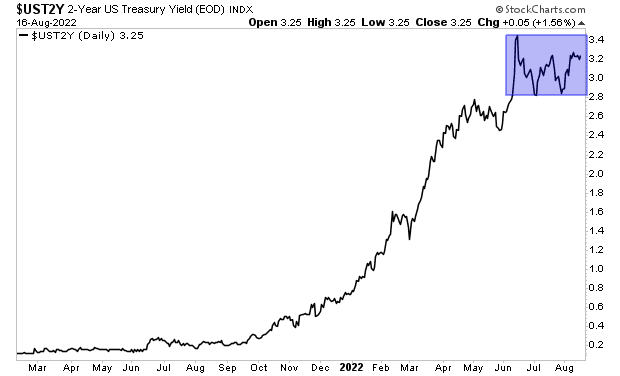

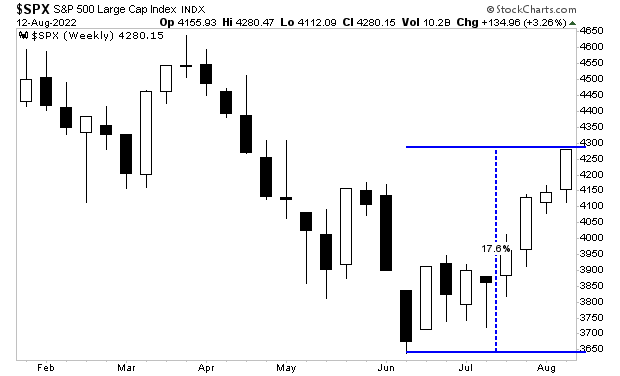

So, according to those buying stocks today, a 0.1% “beat” on an inflation number that is still north of 7% despite the Fed implementing its most aggressive rate hike cycle in 40 years in is a reason to panic bid stocks higher.

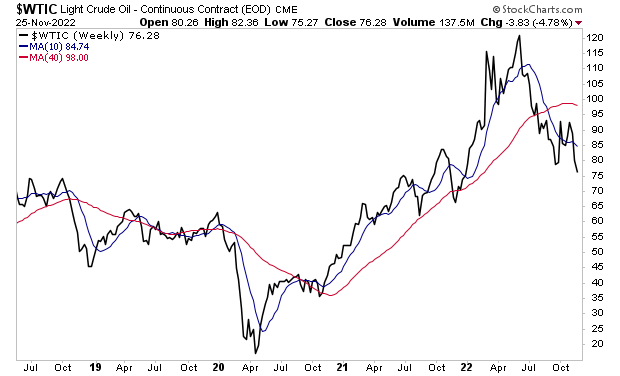

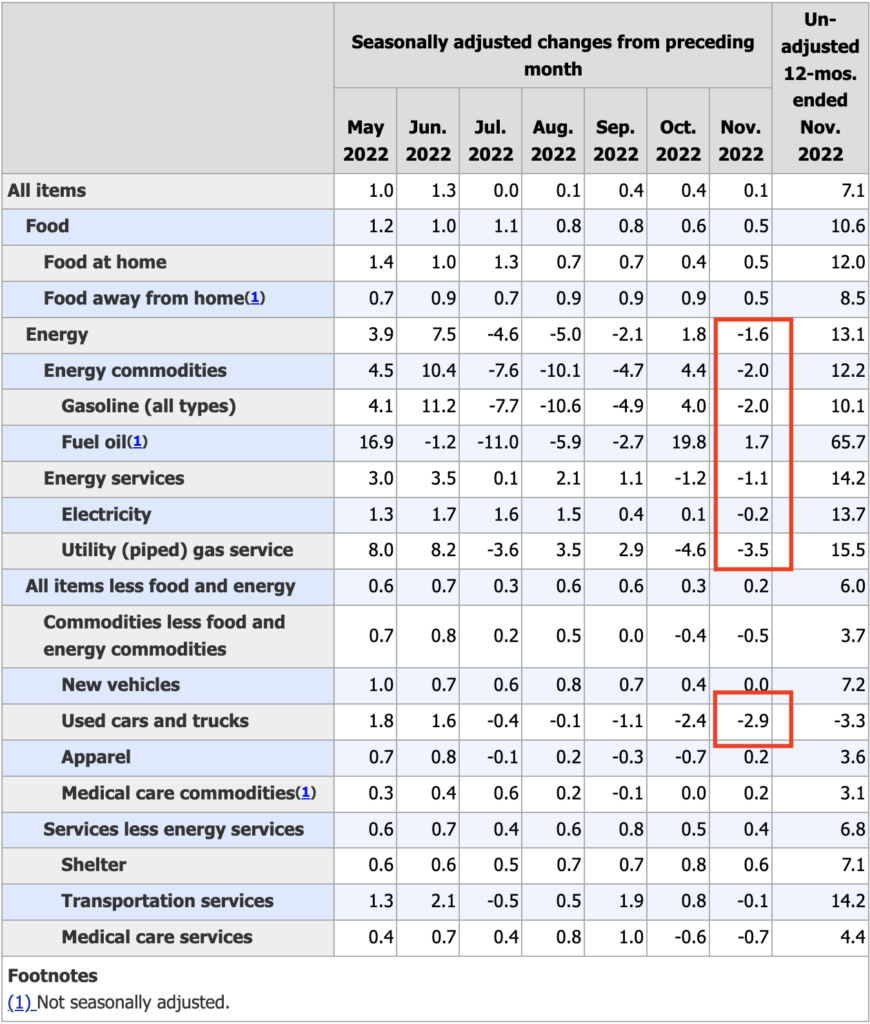

Looking through the numbers, almost the entire drop came courtesy of falling energy prices and used cars. I might add that the drop in energy is not surprising given that the Biden administration drained the Strategic Petroleum Reserve (SPR) by ~180 million barrels of oil. Practically everything outside of energy and used car prices is still rising.

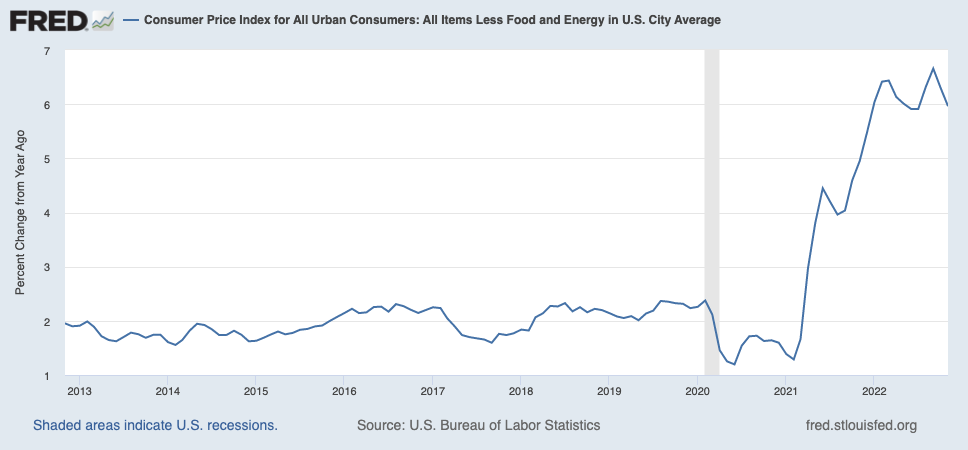

Elsewhere in the report, core inflation, which the Fed looks at closely is still at 6%. Sure, it’s not spiking any higher, but this it’s not coming down much either. Again, this is good in a way, but is it a reason to panic buy stocks like inflation is gone? I don’t think so.

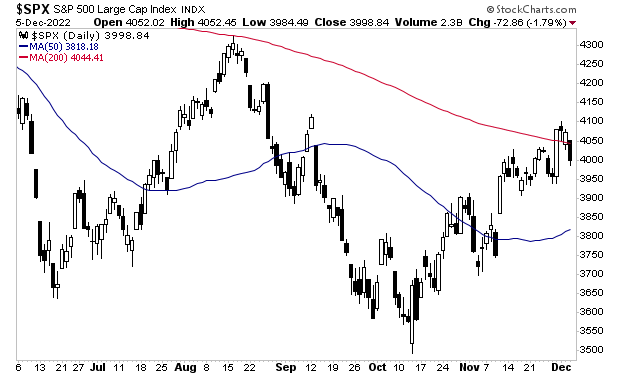

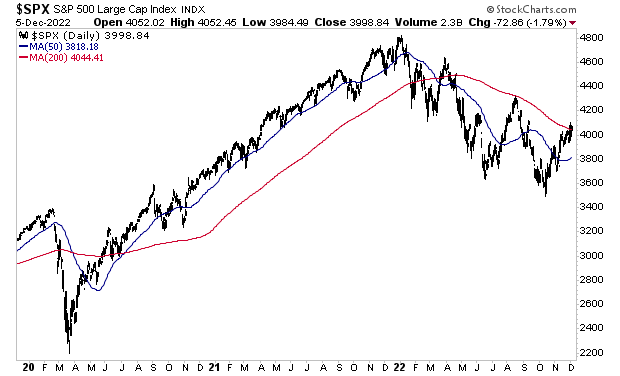

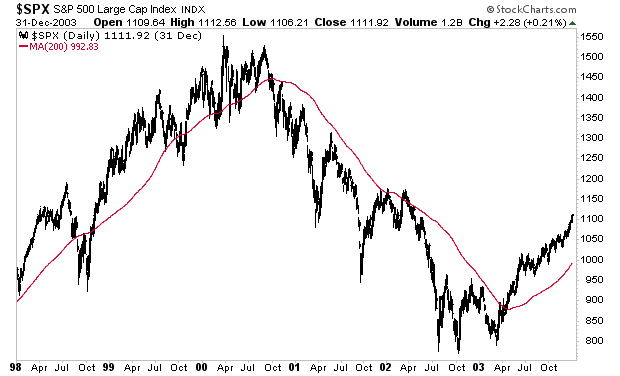

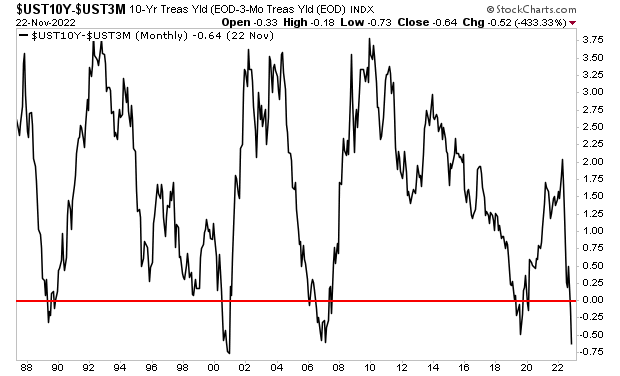

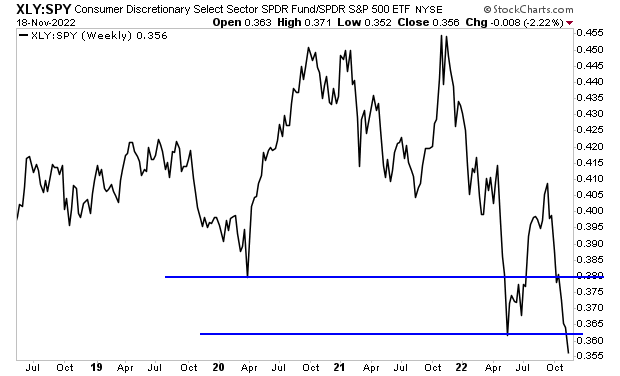

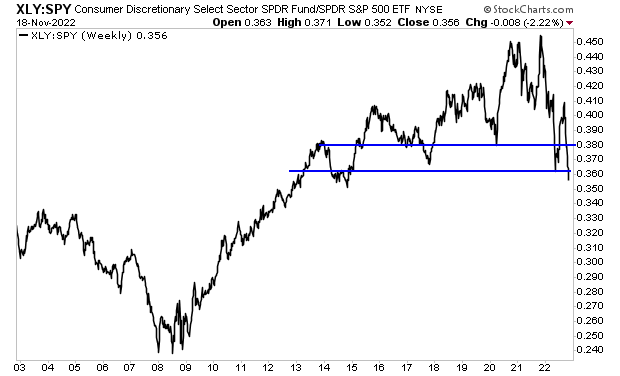

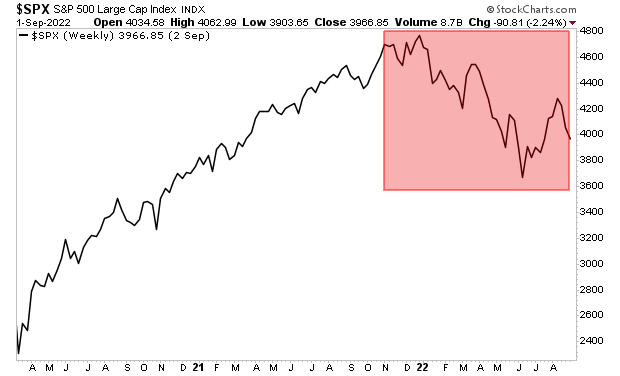

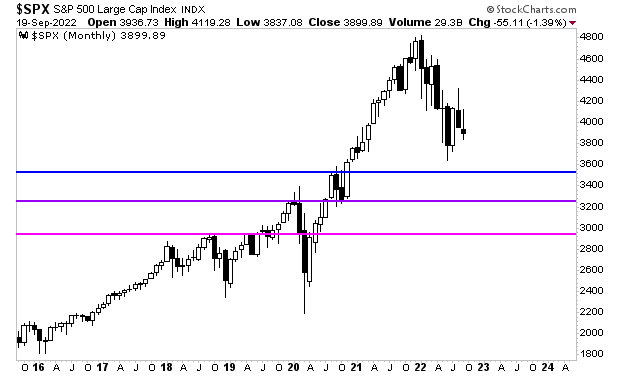

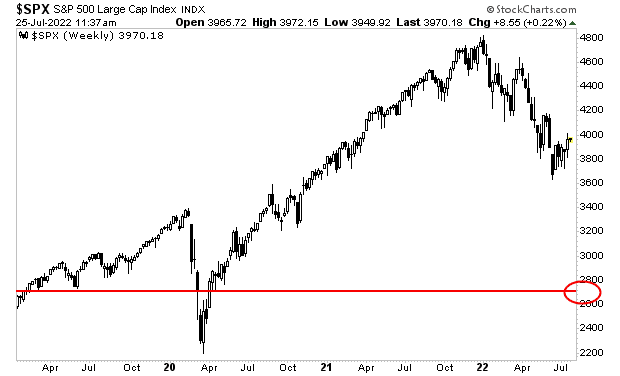

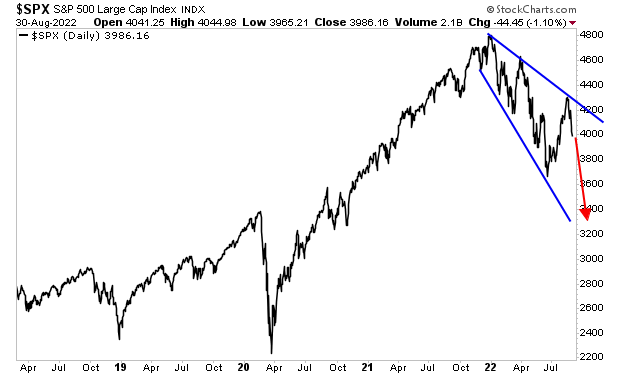

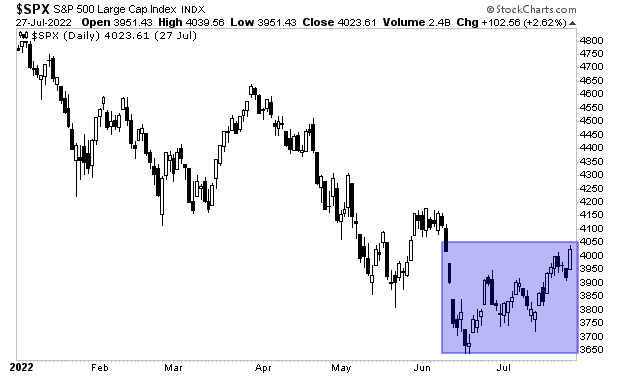

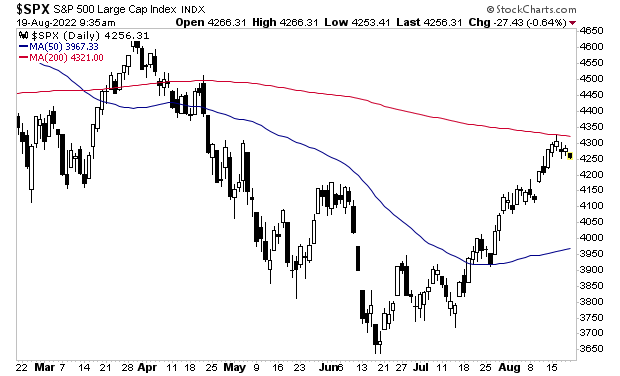

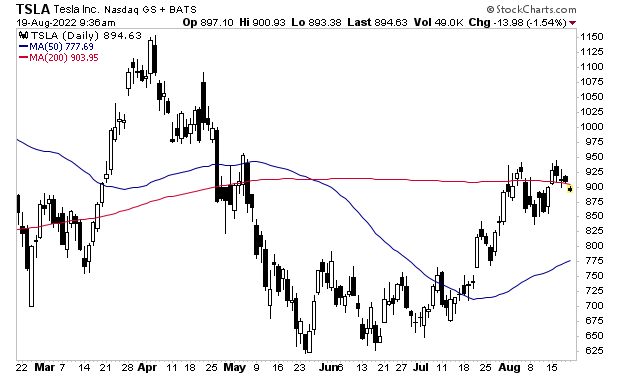

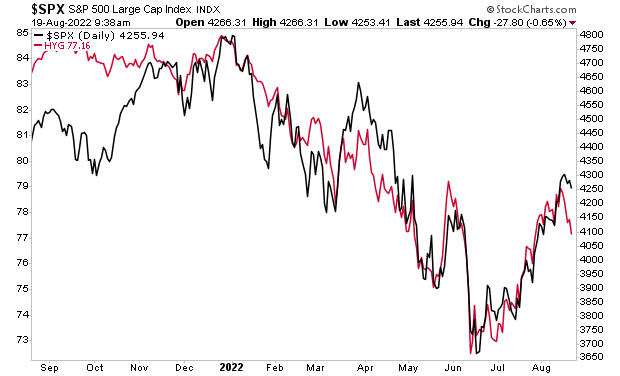

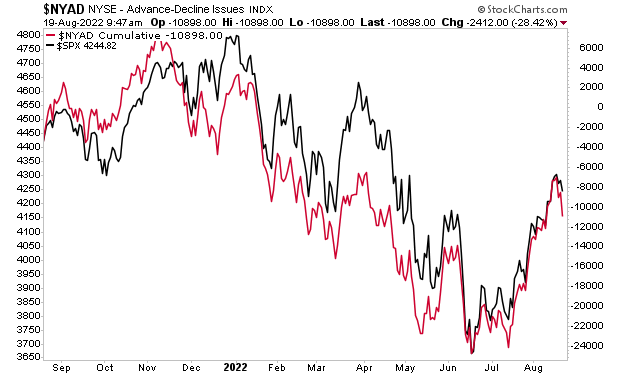

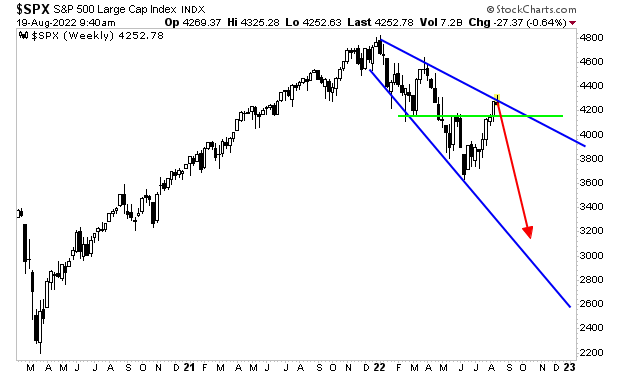

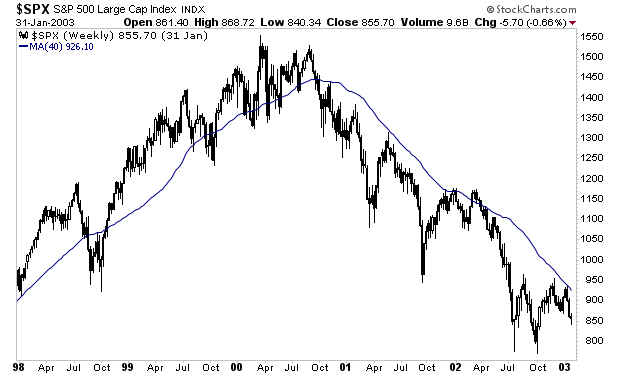

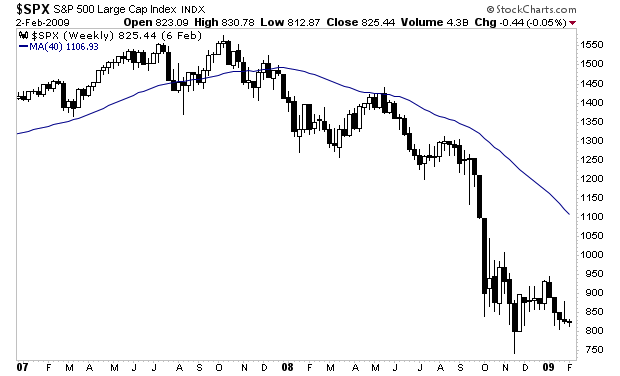

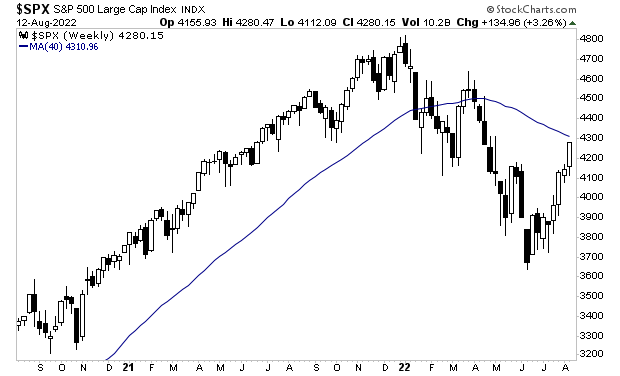

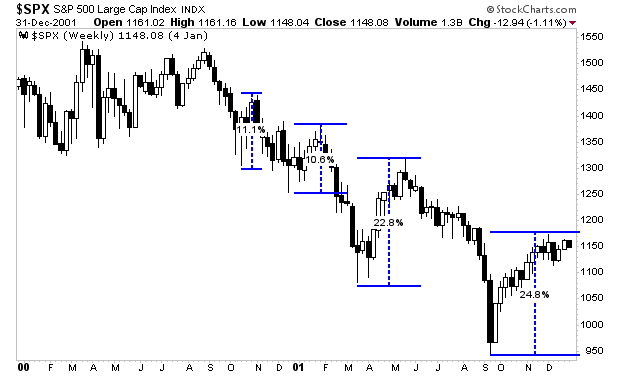

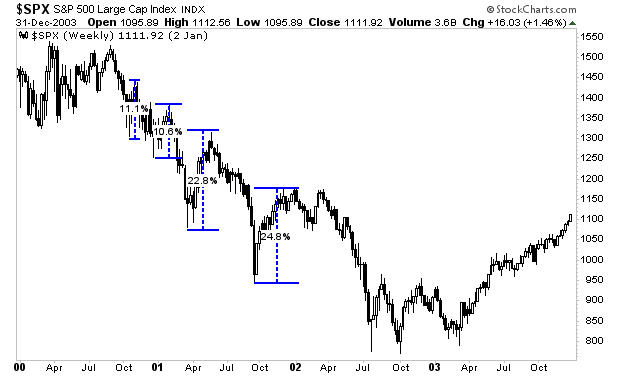

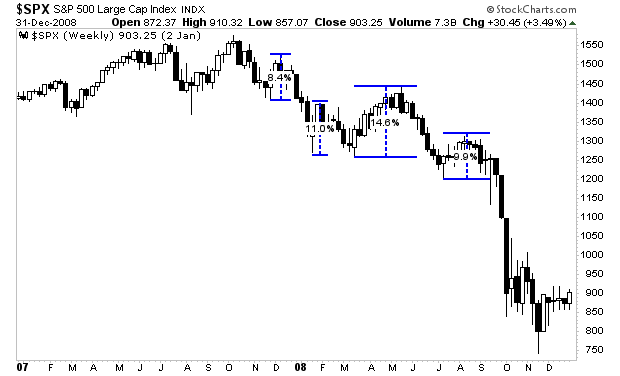

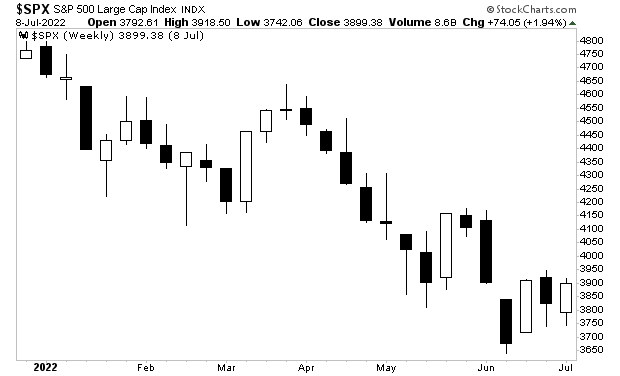

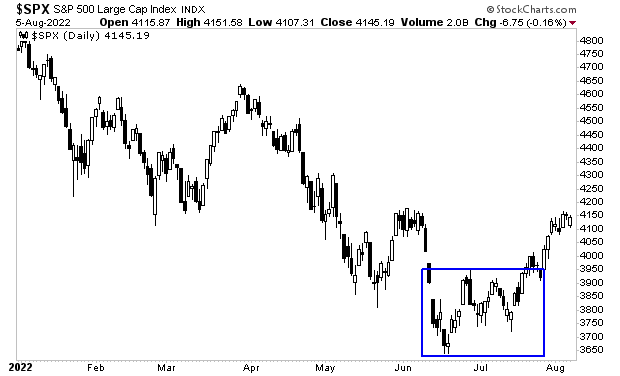

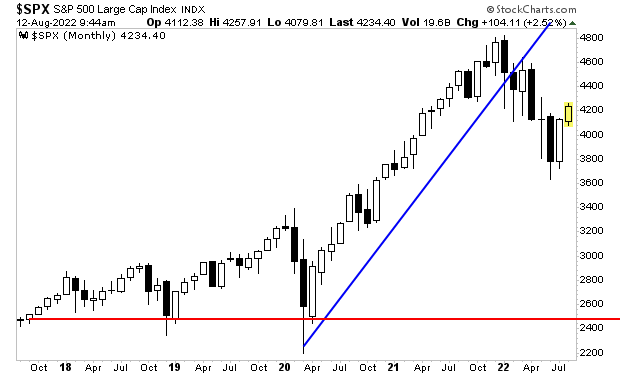

Unfortunately for those who are panic buying stocks today, the bear market is NOT over. With a recession just around the corner, stocks will soon collapse to new lows.

If you’ve yet to take steps to prepare for this, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html