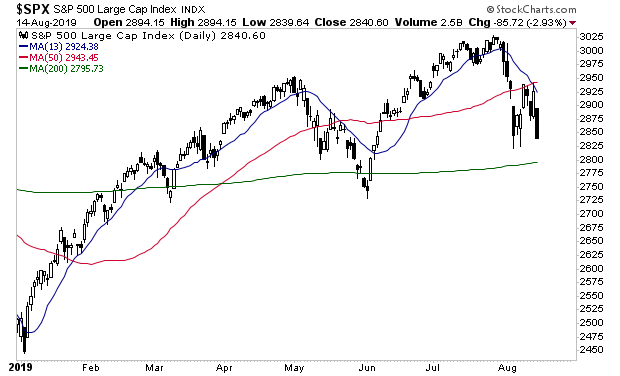

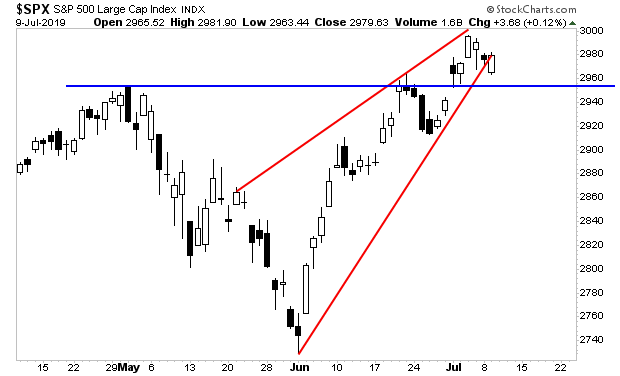

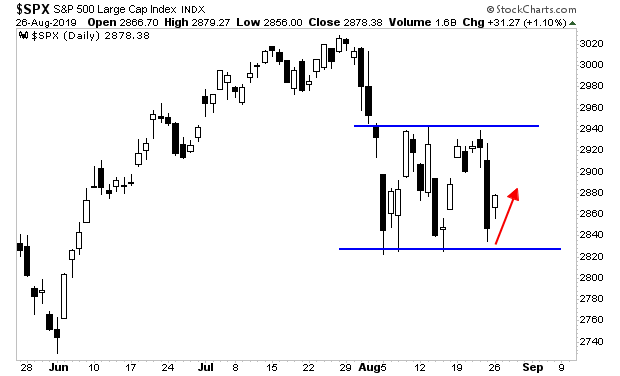

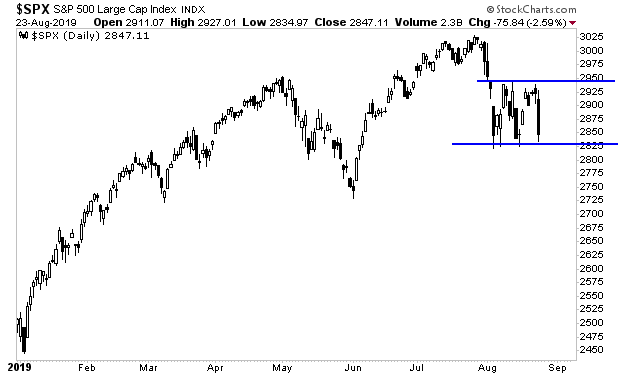

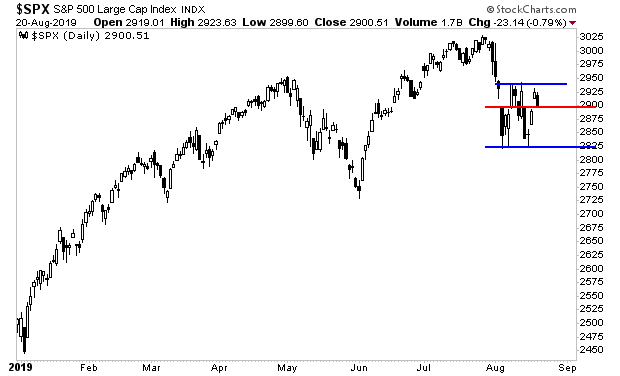

As I noted yesterday, stocks were due for a bounce. That bounce is now underway.

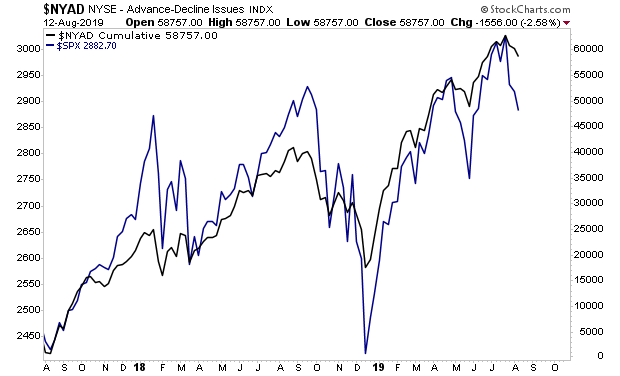

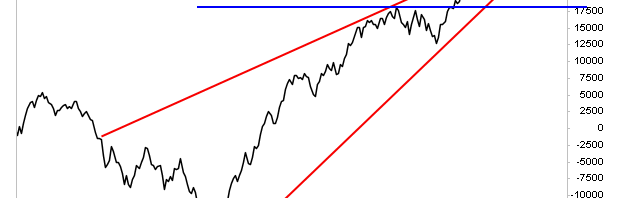

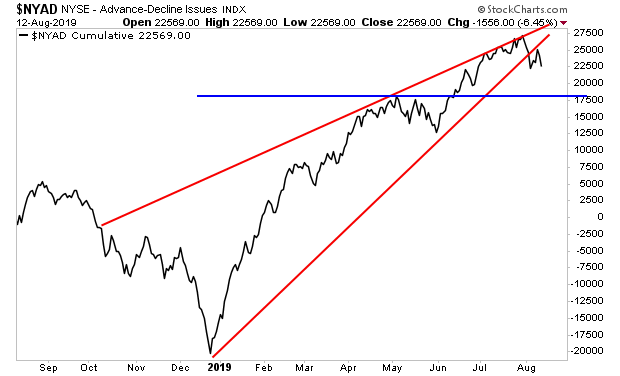

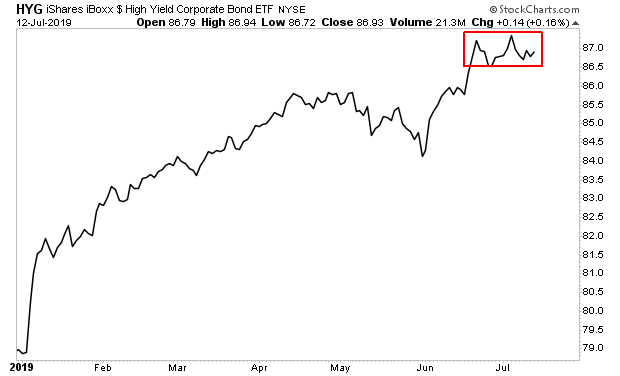

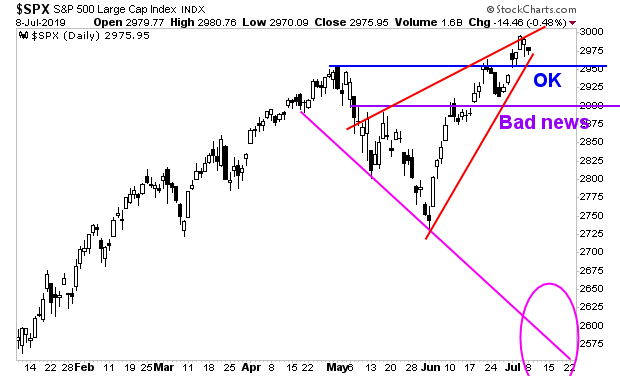

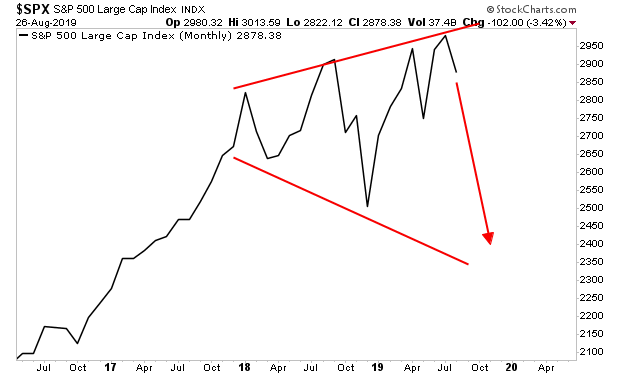

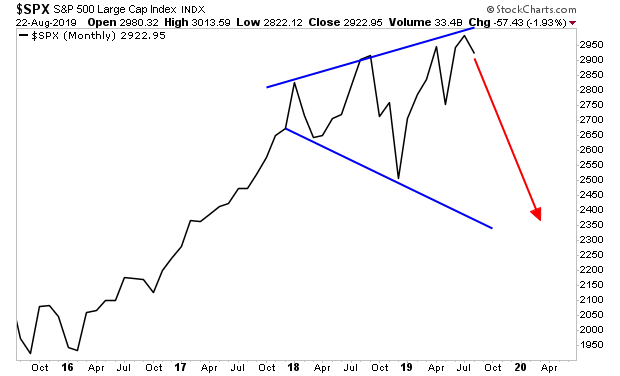

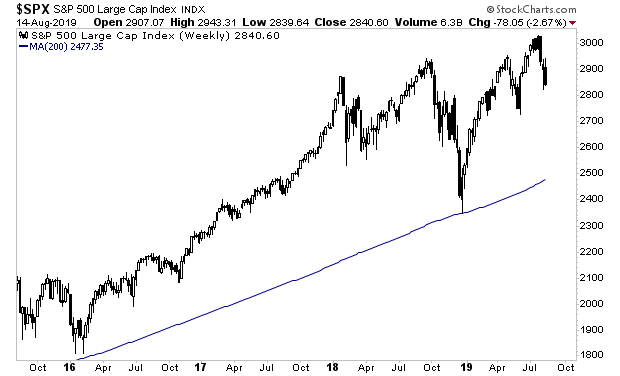

This should hold up a few more days, but then comes the NASTY move the markets have been warning about for weeks.

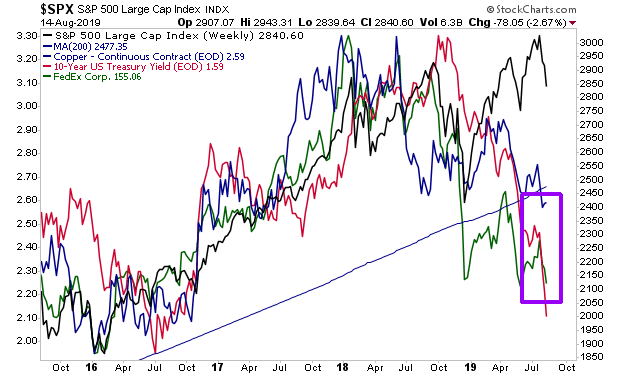

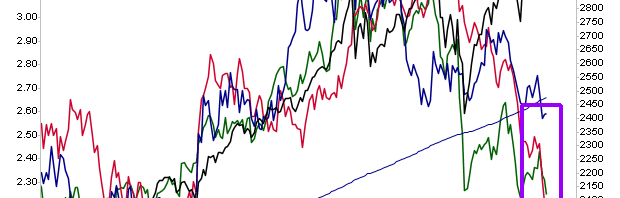

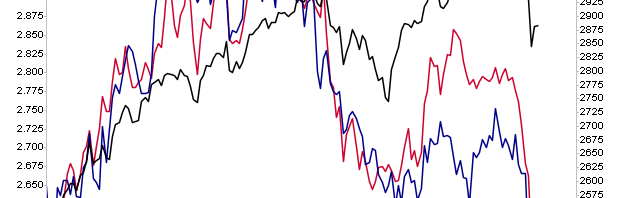

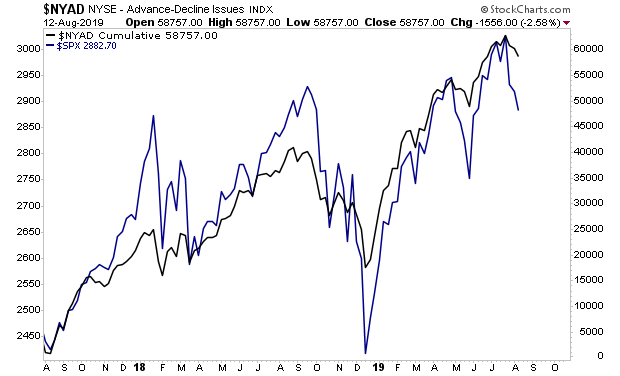

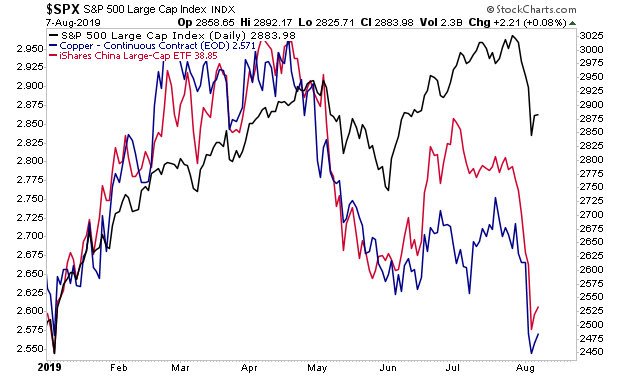

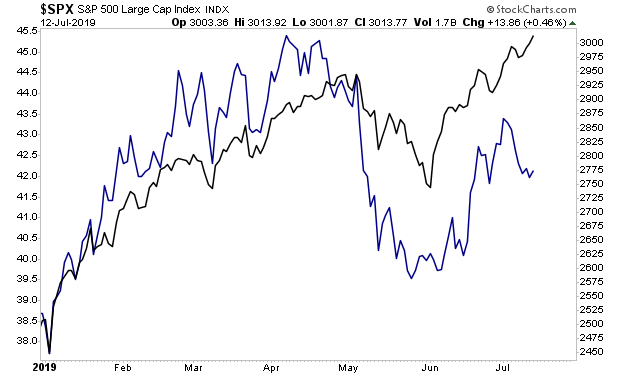

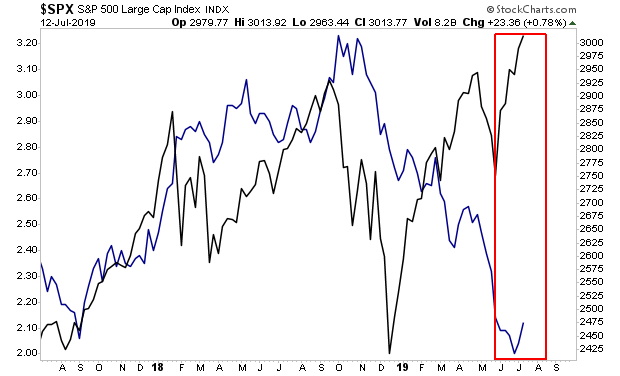

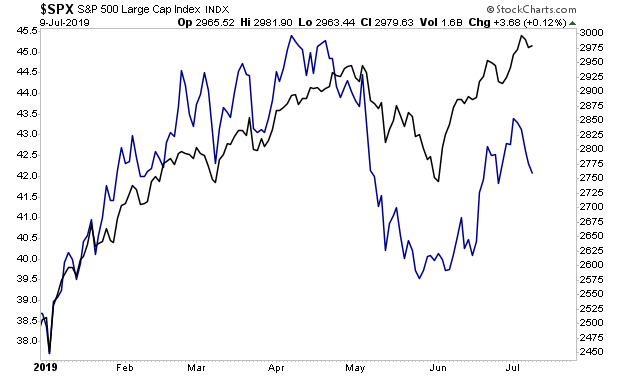

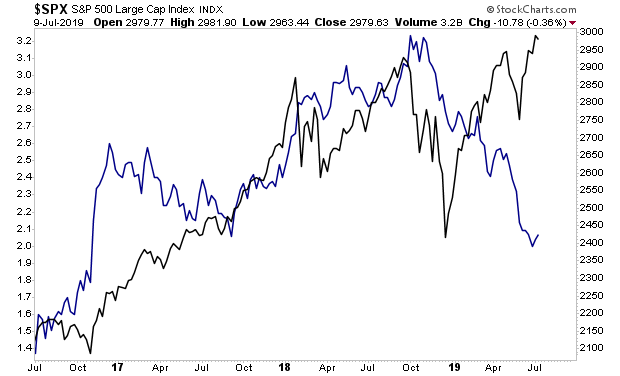

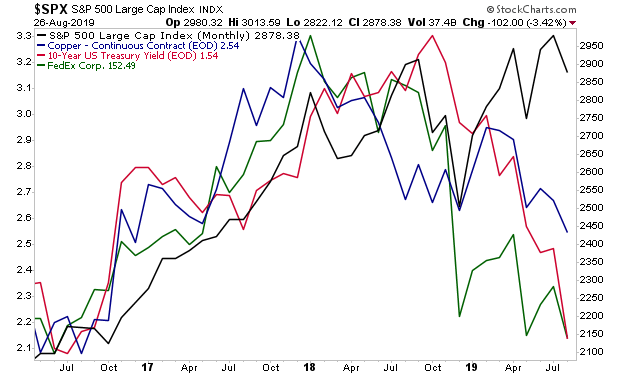

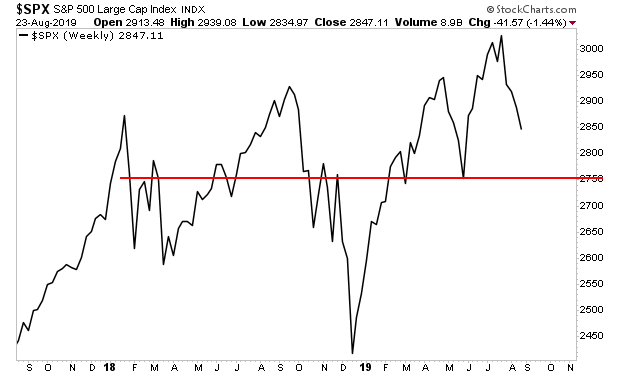

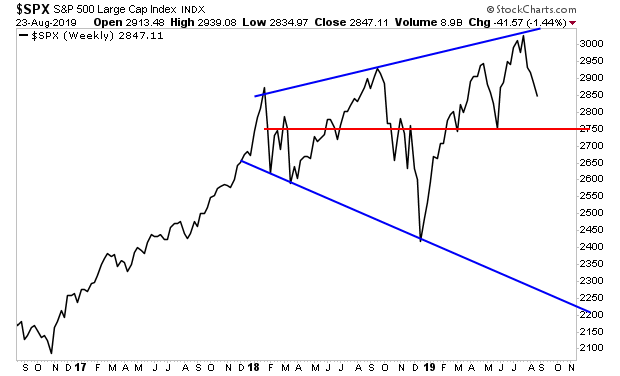

Copper, Treasury Yields, and Fed EX are all real-world economic indicators that tell us what the REAL level of economic activity is in the world.

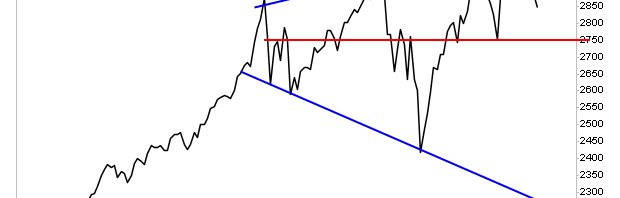

Take a look at what these indicators (blue line, red line and green line) are saying about the state of the world today. Now take a look at where they are relative to stocks (black line).

Deep down, stocks know what’s coming too.

The time to prepare for this is NOW before it happens.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Unfortunately that’s where Copper, Bond Yields, and Fed Ex, all of them real-world economic indicators, indicate that stocks are heading.

Unfortunately that’s where Copper, Bond Yields, and Fed Ex, all of them real-world economic indicators, indicate that stocks are heading.