By Graham Summers, MBA

The Great Debt Crisis of our lifetimes is approaching.

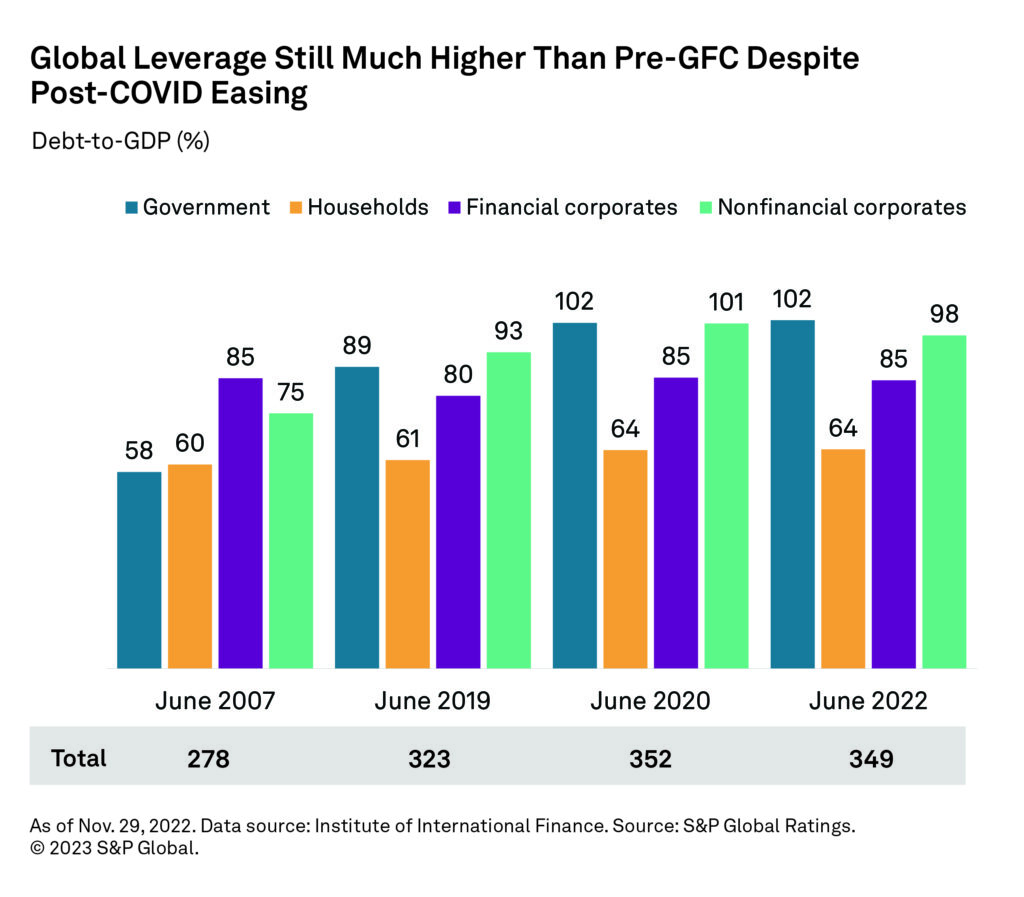

As S&P Global recently noted, global debt has just hit $300 TRILLION for the first time in history. As if that wasn’t jaw dropping enough, this amount of debt represents 349% of global GDP. If you were to spread out this debt across the world population each man woman and child would owe over $36,000.

Put simply, this is an incomprehensibly massive debt bomb. And inflation has lit the fuse.

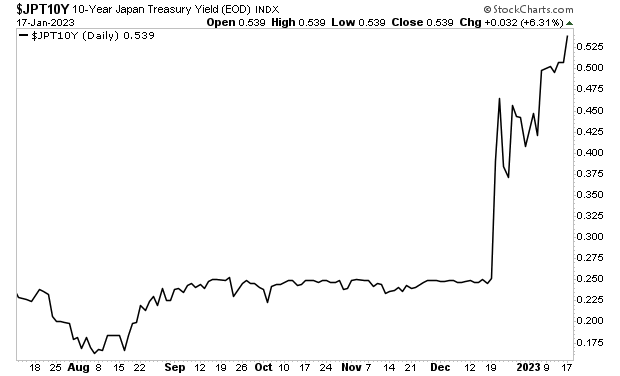

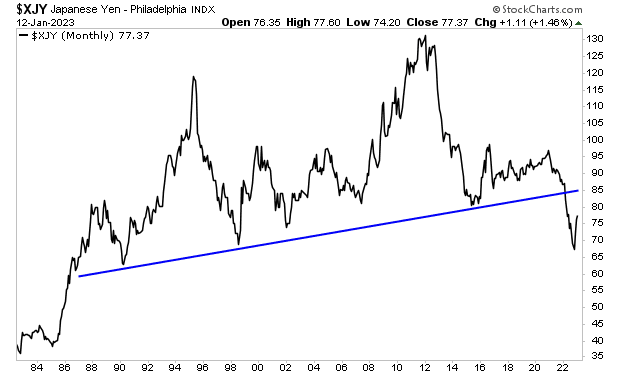

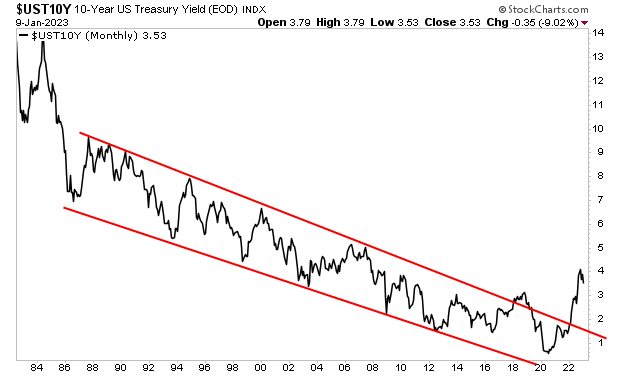

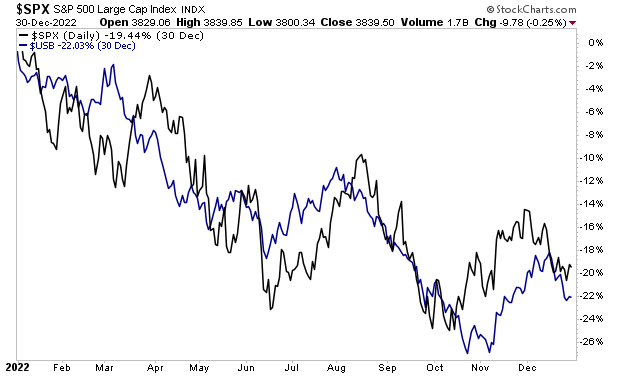

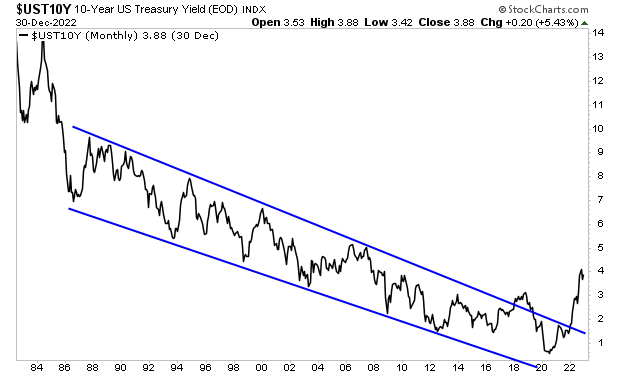

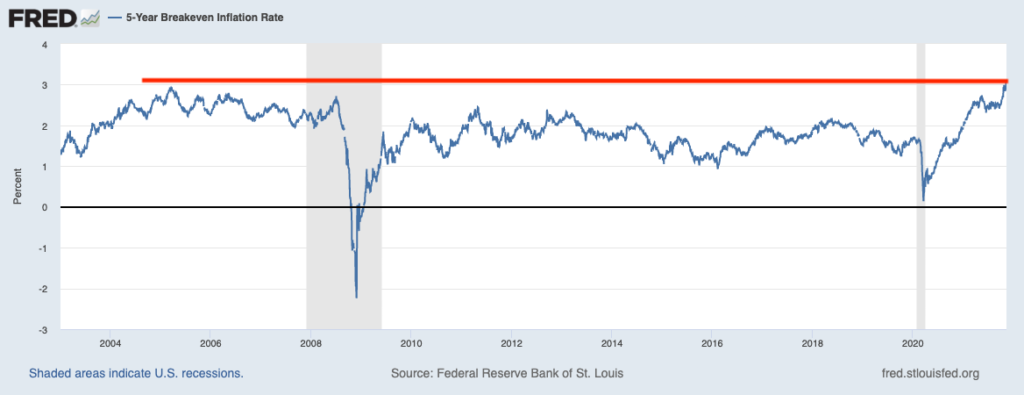

You see, bond yields trade based on inflation among other things. So once inflation entered the financial system in 2021, it was only a matter of time before bonds yields began to rise.

Higher bond yields mean greater debt payments. And greater debt payments mean that it the debt becomes more difficult to service. At a yield of 0.25%, you can service $1,000,000 worth of debt for just $2,500. But at a yield of 5%, that same $1,000,000 in debt now costs $50,000 to service.

Again, inflation lit the fuse of our global debt bomb in 2021. And by the look of things, the fuse has almost burned completely away!

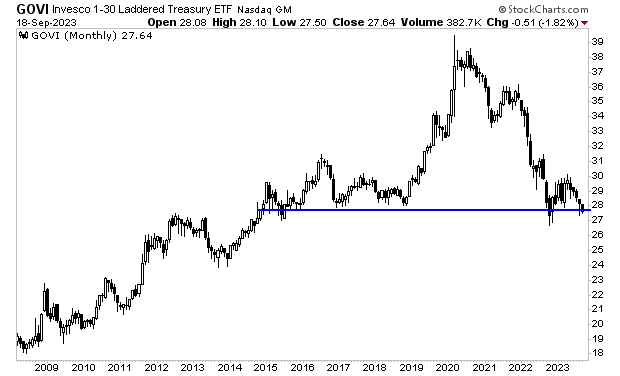

Take a look at the below chart and you’ll see what I mean. This is the Invesco 1-30 Laddered Treasury ETF (GOVI). It’s effectively a proxy for the entirety of the U.S. Treasury market. And as you can see, it is now trading at the same level it first hit in 2015, and just barely clinging to critical support.

Once that line gives way, the great debt crisis of our lifetimes will likely begin.

Smart investors are already taking steps to profit from this.

On that note, we are putting together an Executive Summary outlining how to invest when this Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html