Forget the details and the specifics… here’s the latest news you need to know about.

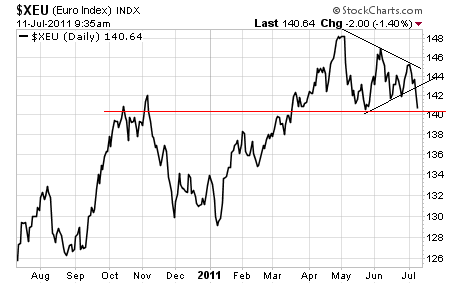

Europe is bankrupt and the EU will not exist in its current form within 12 months. The ECB tried to “bailout our way to success” strategy on some of the more minor players (Greece), but is now finding that there isn’t actually enough money to bail out the larger players (Spain and Italy).

So, barring a leveraged buyout of Italy by Germany and China, the EU will be breaking up and the Euro collapsing within the next 12 months. How this will happen remains to be seen (the EU splits into two sections? Is done away with altogether? Etc). But the facts remain that the EU has reached the end game for bailouts (you cannot bail out entire countries).

The last straw of hope that the bulls are clinging is China’s recent decision to actively buy EU member states’ sovereign debt. Those of us who recall China’s decision to buy Morgan Stanley in 2008 can’t help but wonder if the country has never heard of “due diligence” or if it simply doesn’t care about losing money.

Speaking of China, the People’s Republic is finding out that the Republic made $540 billion worth of loans to the people that:

1) Have not been accounted for

2) Are properly garbage and won’t be paid back

We all know how this scheme ends (see subprime collapse in US). However, given that China pretty much makes up its economic data, it’s pretty safe to assume that the bad loan situation there is even worse than Moody’s believes. So look for a “2008 type” bust in China in the coming months.

And then of course there’s the US: the current least horrendous disaster winner by default (literally in Europe’s case and metaphorically in China’s case). Congress continues to play “debt talk” phone tag with President Obama.

However, to say this is a debate ignores the fact that there isn’t actually two sides to this discussion. Both Congress and the White House are debt-crazed groups who believe throwing good money after bad = recovery. So regardless of whether the debt ceiling is raised or budget talks reach an agreement, the US is broke and will continue to be until we default and restructure our debt obligations.

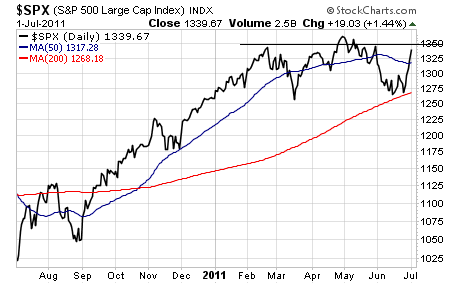

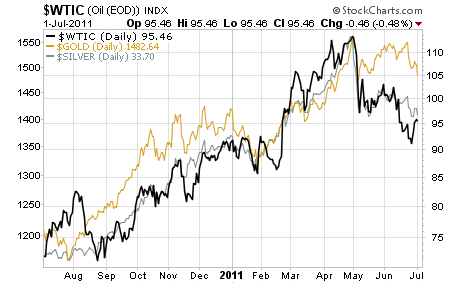

In simple terms, what I’m trying to say is that we are about to witness another “2008” only on a sovereign scale. The EU will be first, but China, Japan, and even the US will be defaulting in the future. The implications these actions have for asset classes will be HUGE as all assets move relative to sovereign bonds which used to be considered the primary low risk asset class in the world.

So expect another bigger Crisis that that will be the equivalent of 2008 all over again, along with food shortages, civil unrest, outbreaks in crime, bank holidays, and the like. It will, in short, be like what’s going on in the Middle East today (though NATO won’t be bombing us).

Which is why if you haven’t already taken steps to prepare yourself and your portfolio for the coming disaster, you need to do so NOW.

I can show you how…

I’ve recently published three key reports titled Protect Your Family, Protect Your Savings, and Protect Your Portfolio all in all 40+ pages of material devoted to showing individual investors how to prepare these areas of their lives in great detail.

I’m talking about how to prepare for bank holidays, food shortages, stock Crashes, debt defaults, civil unrest and more.

When it comes to profiting from this kind of disaster, few people on the planet have my ability to make Crises pay off.

To whit, my clients actually made money in 2008, having been warned a full three weeks in advance of the Crash to get out the market and go short.

I believe we could see another 2008 situation unfold in the near future, which is why I just unveiled six specific trades to subscribers… all of which will pay off HUGE returns as the current stock market collapse accelerates.

So we’re ready for whatever may come. And the worse things get… the more profitable our strategy will be.

If you’ve yet to take these steps yourself, it’s not too late… in fact, you’ve still got time to get your financial “house” in order to not only survive what’s coming… but potentially even make serious money from it.

All you need to do is take out a “trial” subscription to my Private Wealth Advisory newsletter. You’ll immediately be given access to all of the reports I detail above… and you’ll also be on my private client list to receive my bi-weekly investment reports as well as real-time trade updates on when to buy and sell various investments.

And if you should decide that Private Wealth Advisory is not for you, you can ask for a full refund during the first 30 days and I’ll return every cent of your subscription cost.

The reports you’ve downloaded during your “trial” period are yours to keep, even if you choose to cancel.

To get started with you Private Wealth Advisory subscription today, download the Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports and start taking action to prepare for what’s coming…

Good Investing!

Graham Summers

Editor In Chief

Gains Pains & Capital