As I outlined earlier this week, the Artificial Intelligence (AI) revolution is now moving into Phase 2.

All technological revolutions follow two phases:

- The initial breakthrough phase, which occurs before social/legal frameworks are in place.

- The “normalization” phase during which social/legal frameworks are implemented giving the technology a societal and financial legitimacy.

AI was in Phase 1 from late 2022 until the beginning of this year. It is now moving into Phase 2 at a rapid clip. As I noted earlier this week, the Trump Administration has introduced America’s AI Action Plan: a legislative framework for promoting U.S. AI dominance.

The Trump administration is not the only institution working to introduce platforms/ frameworks for AI’s integration into society. The State of California has introduced legislation designed to limit the U.S. of AI in hiring, disciplining and firing employees.

Other developments of note:

- Congress has introduced a bill limiting the US of personal data/ copyrighted information for AI training.

- Congress has also introduced the Unleashing AI Innovation in Financial Services Act (H.R. 4801), that provides a framework for introducing AI to financial services firms.

- The State of Pennsylvania is taking steps to mitigate environmental impacts of AI data centers being built.

- The State of Illinois has signed a bill into law that limits the use of AI in therapy services.

- Police in the city of San Jose are using AI to communicate to Spanish-speaking residents.

- Dallas is hosting a conference Crimes Against Children Conference through which police, social workers and child advocates can learn/ teach about the risks of AI to children and their mental health.

And more…

Everywhere you look, major legislative bodies, policy groups and other institutions are working to introduce legal/societal frameworks for AI’s integration to society. Every single one of these developments will shape the landscape of AI as well as the investment opportunities it presents to investors.

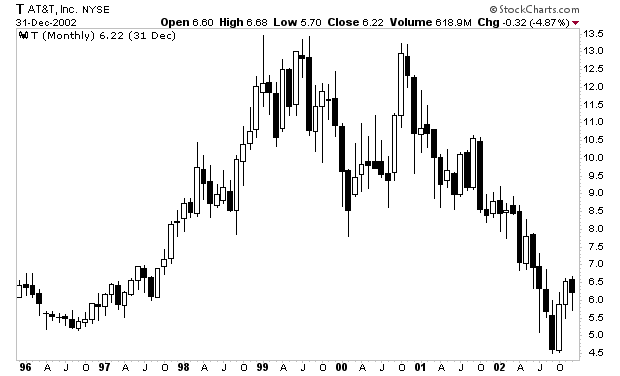

Remember, the BIG money is made when a technology enters Phase 2 of its revolution. To return to the “Napster metaphor” I used earlier this week, Napster represented Phase 1 of the electronic music file or MP3 revolution: it was the market leader that moved into the space first before the proper legal frameworks were in place. At its peak Napster had tens of millions of users.

The Apple introduced iTunes: a version of MP3 technology in which MP3s could be bought and sold in a legally acceptable form. Napster collapsed, but iTunes went on to become one of Apple’s most profitable business segments.

Napster is still around. Its marketing promotes the fact it is “100% legal.” And it has about five million users. At its peak, iTunes hit 500+ million users and accounted for 63% of all digital music sales. It is now in the process of being converted over to Apple Music, a new service that also offers music streaming and other services in order to compete with Spotify which is the new market leader. So once again, the technology has changed and requires adaption.

And streaming music is now $46 billion market.

So again, if you’re worried you missed out on the AI revolution, do NOT be concerned. The REAL money will be made during Phase 2… which only just began.

On that note, we just published a new special investment report The AI Plays Your Broker Doesn’t Know About that details three unique investments designed to profit from the revolution in physical AI. Best of all, Wall Street has little to no idea these companies even exist, let alone their potential.

We are making just 99 copies available to the public. To pick up yours…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research