The global bond bubble has begun bursting.

This process will not be fast by any means.

Central Banks and the political elite will fight tooth and nail to maintain the status quo, even if this means breaking the law (freezing bank accounts or funds to stop withdrawals) or closing down the markets (the Dow was closed for four and a half months during World War 1).

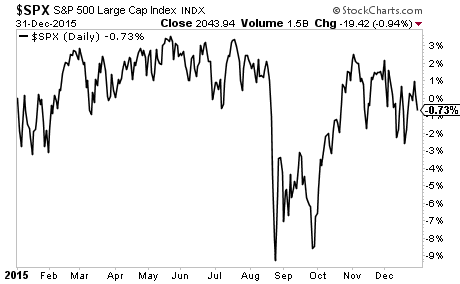

There will be Crashes and sharp drops in asset prices (20%-30%) here and there. However, history has shown us that when a financial system goes down, the overall process takes take several years, if not longer.

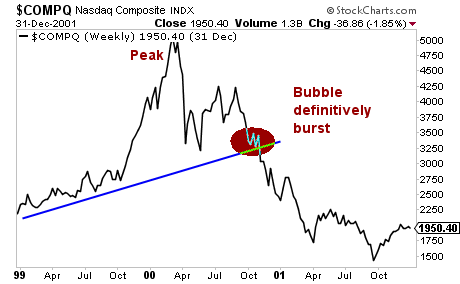

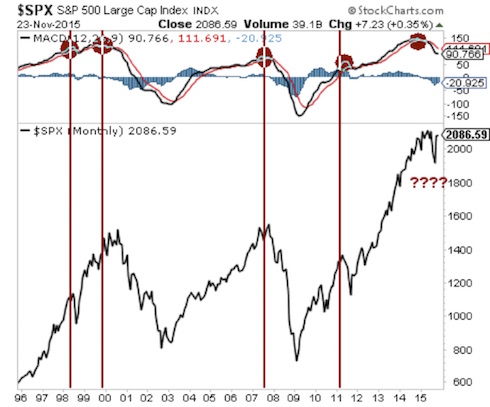

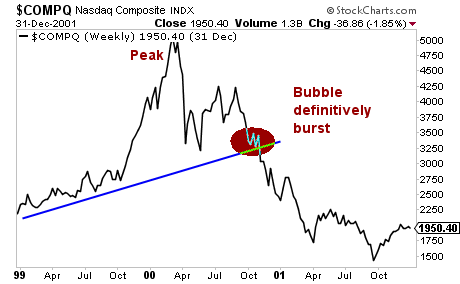

By way of example let us consider the details surrounding the Tech Bubble: the single largest stock market bubble of the last 100 years. In this case, the Bubble pertained to just one asset class (stocks). In fact, the bubble was relatively isolated to one specific sector, Tech Stocks.

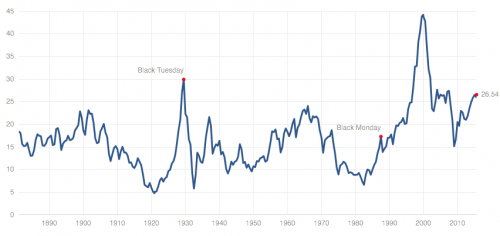

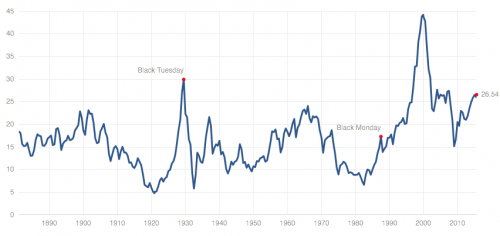

And to top if off, it was absolutely obvious to anyone that it was a Bubble: note that the Cyclical Adjusted Price to Earnings or CAPE ratio for the Tech Bubble dwarfed all other bubbles dating back to 1890.

Stocks were so obviously overvalued that it was truly absurd.

Stocks were so obviously overvalued that it was truly absurd.

And yet, despite the fact that this bubble was absolutely obvious and involved only one asset class, it still took investors well over six months after the initial 20% crash to realize that the top was in and the bubble had burst.

———————————————————————–

The Opportunity to Make Triple If Not QUADRUPLE Digit Gain is Here

The largest investor fortunes in history were made during crises.

For that reason, we’ve launched a special options trading service designed specifically to profit from the coming crisis.

It’s called THE CRISIS TRADER and already it’s locking in triple digit winners including gains of 151%, 182%, 261% and even 436%!

And the REAL crisis hasn’t even started yet!

We have an success rate of 72%(meaning you make money on more than 7 out of 10 trades)…and thanks to careful risk control, we’re outperforming the S&P 500 by over 50%!

Our next trade is going out shortly… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

CLICK HERE NOW!!!

———————————————————————–

Let that sink in for a moment. Stocks were clearly in a bubble. Indeed, it was literally THE stock bubble of the last 100 years. And yet, when it burst, there was no clear consensus as to where the market was heading.

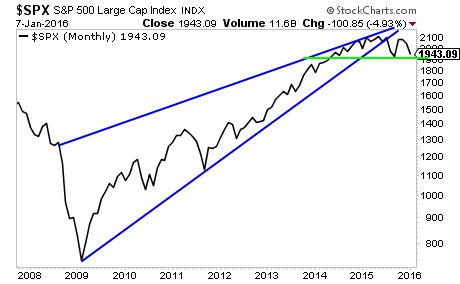

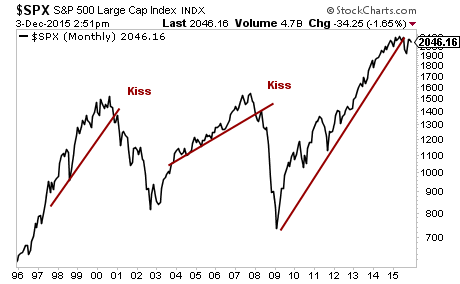

My point with all of this is that even when the bubble was both very specific AND obvious, the collapse was neither quick nor clean. There were several large 20%+ crashes, but overall, it was a roller coaster with jarring rallies than gradually wore its way down.

And when you extend the collapse from peak to bottom, the whole collapse took nearly three years.

To return to my initial point: the coming collapse in the financial markets will take its time. This is particularly true this time around because the bubble pertains to bonds: the senior-most asset class in the financial system.

By way of explanation, let’s consider how the current monetary system works…

The current global monetary system is based on debt. Governments issue sovereign bonds, which a select group of large banks and financial institutions (e.g. Primary Dealers in the US) buy/sell/ and control via auctions.

These financial institutions list the bonds on their balance sheets as “assets,” indeed, the senior-most assets that the banks own.

The banks then issue their own debt-based money via inter-bank loans, mortgages, credit cards, auto loans, and the like into the system. Thus, “money” enters the economy through loans or debt. In this sense, money is not actually capital but legal debt contracts.

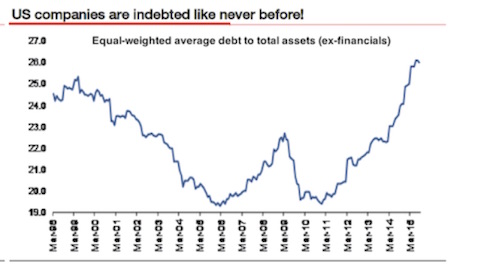

Because of this, the system is inherently leveraged (uses borrowed money).

Consider the following:

- Total currency (actual cash in the form of bills and coins) in the US financial system is little over $1.2 trillion.

- If you want to include money sitting in short-term accounts and long-term accounts the amount of “Money” in the system is about $10 trillion.

- In contrast, the US bond market is well over $38 trillion.

- If you include derivatives based on these bonds, the financial system is north of $191 trillion.

Bear in mind, this is just for the US.

Again, debt is money. And at the top of the debt pyramid are sovereign bonds: US Treasuries, German Bunds, Japanese Government Bonds, etc. These are the senior most assets used as collateral for interbank loans and derivative trades. THEY ARE THE CRÈME DE LA CRÈME of our current financial system.

So, this time around, when the bubble bursts, it won’t simply affect a particular sector or asset class or country… it will affect the entire system.

So…. the process will take considerable time. Remember from the earlier pages, it took three years for the Tech Bubble to finally clear itself through the system. This time it will likely take as long if not longer because:

- The bubble is not confined to one country (globally, the bond bubble is over $100 trillion in size).

- The bubble is not confined to one asset class (all “risk” assets are priced based on the perceived “risk free” valuation of sovereign bonds… so every asset class will have to adjust when bonds finally implode).

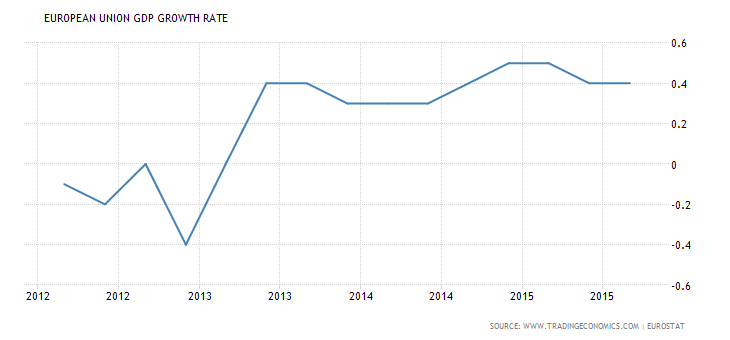

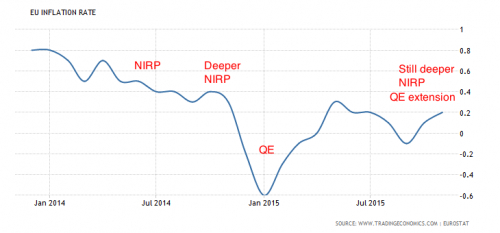

- The Central Banks will do everything they can to stop this from happening (think of what the ECB has been doing in Europe for the last three years)

- When the bubble bursts, there will very serious political consequences for both the political elites and voters as the system is rearranged.

The size of the bond bubble alone should be enough to give pause.

However, when you consider that these bonds are pledged as collateral for other securities (usually over-the-counter derivatives) the full impact of the bond bubble explodes higher to $555 TRILLION.

To put this into perspective, the Credit Default Swap (CDS) market that nearly took down the financial system in 2008 was only a tenth of this ($50-$60 trillion).

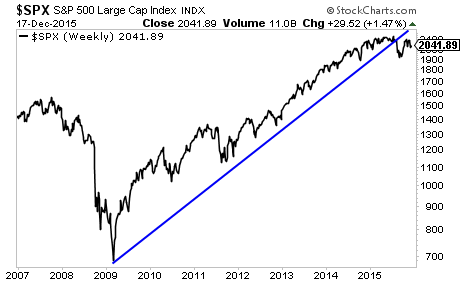

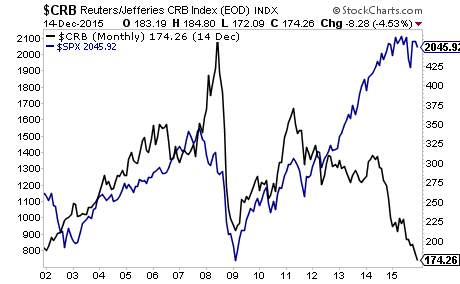

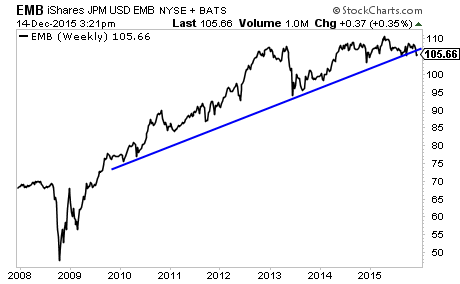

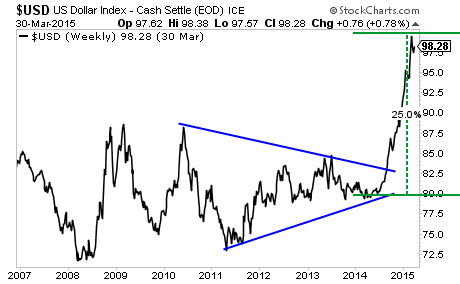

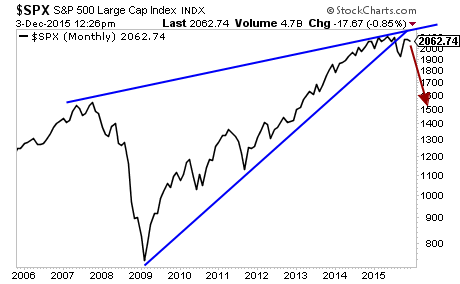

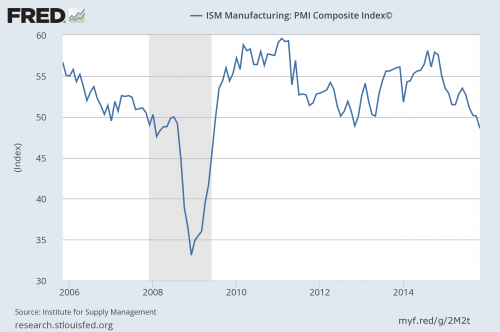

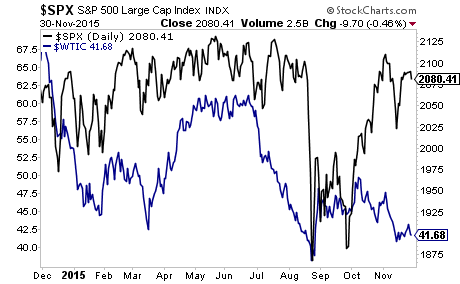

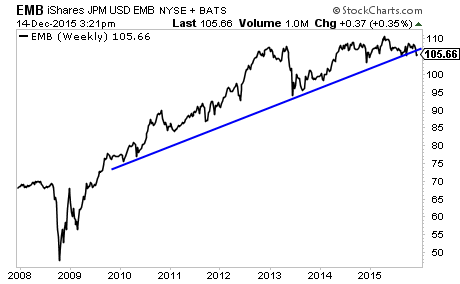

On that note, we should point that the fuse is already lit on the global debt bomb. Emerging Market bonds taking out their bull market trendline.

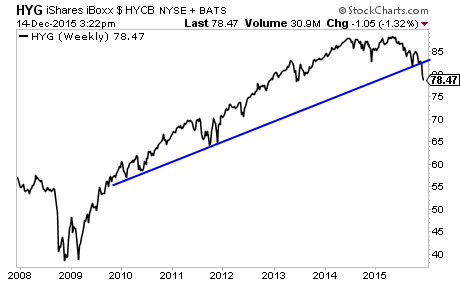

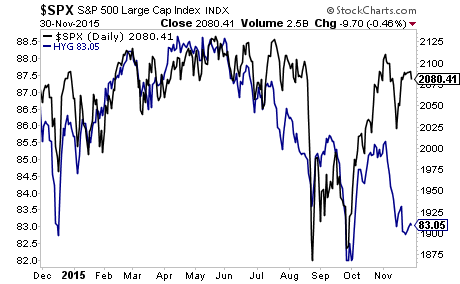

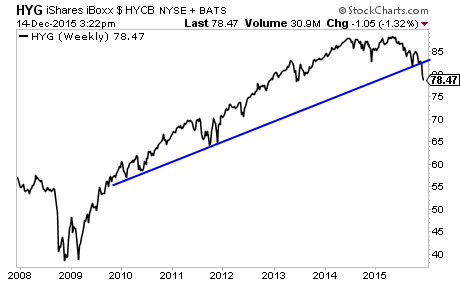

Junk bonds are also in the process of ending their multi-year bull market.

Junk bonds are also in the process of ending their multi-year bull market.

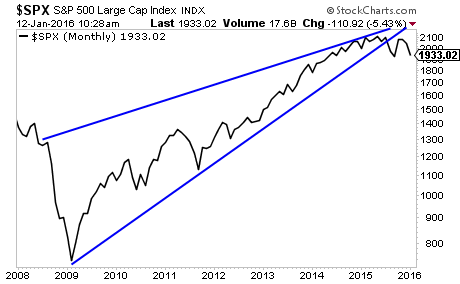

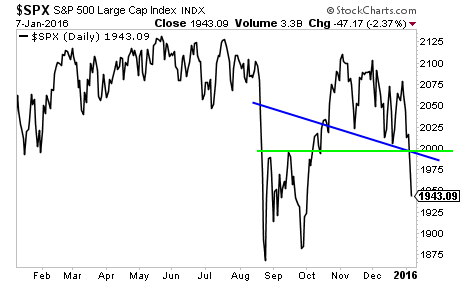

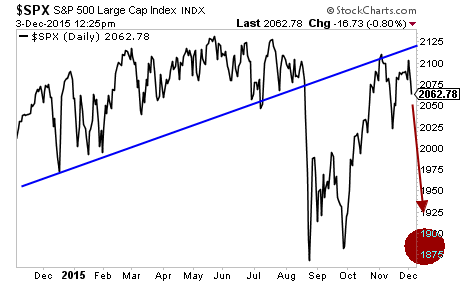

The bursting of the bond bubble has begun. This process will take months to unfold and it will culminate in a stock market crash.

The bursting of the bond bubble has begun. This process will take months to unfold and it will culminate in a stock market crash.

Private Wealth Advisory subscribers are already profiting from the markets, having just closed THREE more winners yesterday, bringing us to a FORTY THREE trade winning streak…

What is Private Wealth Advisory?

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets. Every week you get pages of high quality editorial presenting market conditions and outlining the best trades to make to profit from them.

It is the only newsletter to have closed 72 consecutive winning trades in a 12 month period (ZERO losers during that time). And we just began another winning streak last year, already racking up 43 straight winners.

And we’ve only closed ONE loser in the last FOURTEEN MONTHS.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents.

However, this offer will be expiring tomorrow at midnight. I cannot maintain a track record of over a YEAR of straight winners with thousands and thousands of investors following these recommendations.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory… and lock in one of the few remaining slots….

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research