Stocks are rallying because Ben Bernanke speaks at Congress on Wednesday. Stocks historically rally into Bernanke speeches.

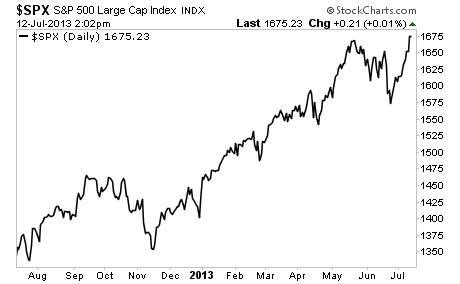

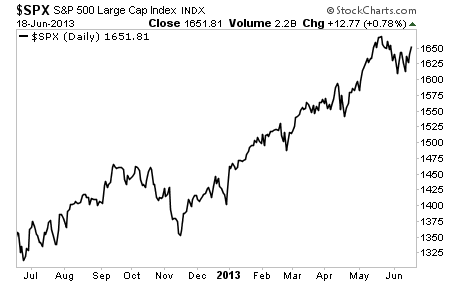

The markets are at new all time highs. But it is now clear that Bernanke has absolutely no clue what he’s doing.

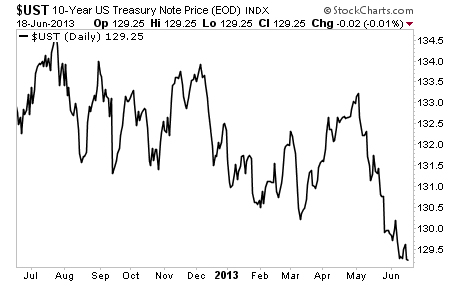

Just two months ago, Bernanke hinted at tapering QE. Note, he didn’t actually taper anything he just hinted at it.

This talk of tightening lasted all of two months. And remember, throughout this period of hinted the Fed was spending $85 BILLION per month via QE 3 and QE 4.

Imagine if you were in the car with a driver who was going 85 MPH down a road with a speed limit of 35 MPH (this isn’t a bad metaphor as there is absolutely no evidence that QE creates jobs or GDP growth so there is no reason for the Fed to be doing it in the first place).

The guy is obviously out of control. The dangers of driving this fast are myriad (crashing, running someone over, etc.) while the benefits (you might get where you want to go a little faster assuming you don’t crash) are minimal.

Now imagine that the driver turned to you and said, “I’m thinking about slowing down.” Seems like a great idea doesn’t it? But then a mere two minutes later he says “ we need to continue at 85 MPH for the foreseeable future.”

At this point any sane person would scream, “STOP.” The driver is clearly a madman and shouldn’t be let anywhere near the driver’s seat. Moreover, he’s totally lost all credibility and isn’t to be trusted.

That’s our Fed Chairman.

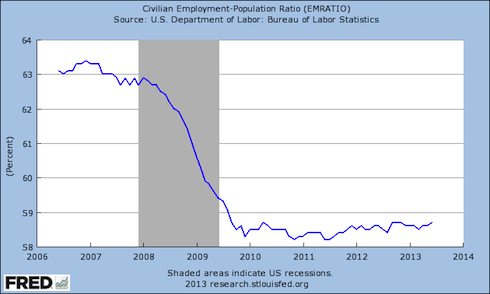

As I’ve noted before… QE, which doesn’t create jobs or GDP growth, does create inflation. The cost of everything is soaring in the US. Since 2002, the cost of just about every item you buy at the grocery store is up in a big way. Check out this list compiled at The Blaze:

- Eggs: 73%

- Coffee: 90%

- Peanut Butter: 40%

- Milk: 26%

- A Loaf Of White Bread: 39%

- Spaghetti And Macaroni: 44%

- Orange Juice: 46%

- Red Delicious Apples: 43%

- Beer: 25%

- Wine: 60%

- Electricity: 42%

- Margarine: 143%

- Tomatoes: 22%

- Turkey: 56%

- Ground Beef: 61%

- Chocolate Chip Cookies: 39%

The damage doesn’t stop there. The cost of everything from healthcare to college tuition is soaring. Heck, even the new Twinkies are smaller, but cost the same (a “hidden” price increase).

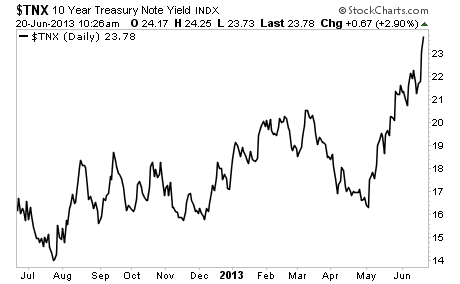

Make no mistake, inflation is entering the US financial system in a big way.

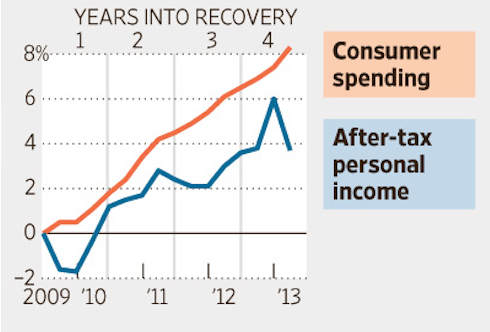

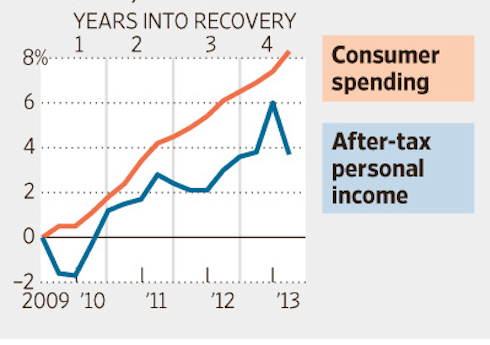

Inflation is good for stocks at the beginning. But then it eats into profits very quickly. At that time, things get really ugly for the markets.

Speaking of which… corporate profits are falling sharply, as is GDP, while stocks continue to rally hard.

Sounds a bit like 2007-2008 doesn’t it?

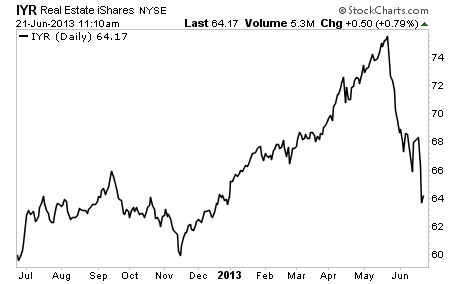

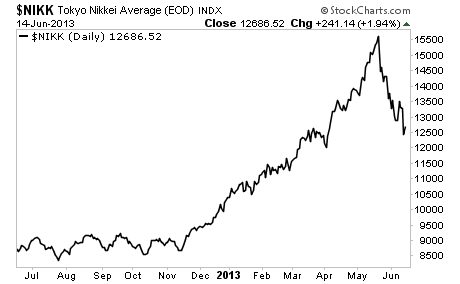

Stocks may hit new highs, but this rally has all the hallmarks of a blow off top, coming at the final stage of a bubble. Indeed, stocks have not been this overextended in over 20 years… that includes the 2007 peak. Soon after we reached that point… we then plunged into one of the worst market Crashes of all time.

By today’s metrics, this would mean the S&P 500 falling to 1,300 then eventually plummeting to new lows.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers